Tesla Grants Elon Musk $29 Billion Stock Award Amid Financial Pressures

Published: August 5, 2025, 15:30 EDT

Tesla Inc. has awarded CEO Elon Musk a new stock grant worth approximately $29 billion, aiming to retain his leadership despite recent challenges to the company’s performance and growing investor scrutiny. The grant comes as Tesla navigates declining profits, increased competition, and political controversy surrounding Musk’s public affiliations.

Tesla Reinstates Compensation After Court Setback

In a regulatory filing on Monday, Tesla announced that it had granted Musk 96 million restricted shares as a “first step” to acknowledging his role in driving the company’s value and transformation since 2018.

The award follows a legal setback earlier this year when a Delaware court struck down Musk’s original 2018 compensation package. Delaware Chancellor Kathleen St. Jude McCormick ruled that the original deal — potentially worth $56 billion — was improperly structured due to Musk’s outsized influence and the lack of independence among Tesla’s board members during negotiations.

Tesla has since appealed the ruling and said the new grant is part of an ongoing effort to align Musk’s interests with long-term shareholder value.

“Rewarding Elon for what he has done and continues to do for Tesla is the right thing to do,” the company said, citing a $735 billion increase in market capitalization since 2018.

Shareholders Divided as Company Faces Growing Challenges

The new stock grant comes at a time when Tesla is under significant pressure. The company’s stock has declined nearly 25% year-to-date, reflecting growing concern over Musk’s political involvement and Tesla’s declining financial performance.

In its most recent quarterly earnings report, Tesla posted a steep drop in profit — from $1.39 billion to $409 million — and missed revenue expectations, further fueling investor anxiety.

Competition is also intensifying, with traditional automakers ramping up electric vehicle production and Chinese EV companies capturing larger shares of the global market.

Political Ties and Management Focus Raise Concerns

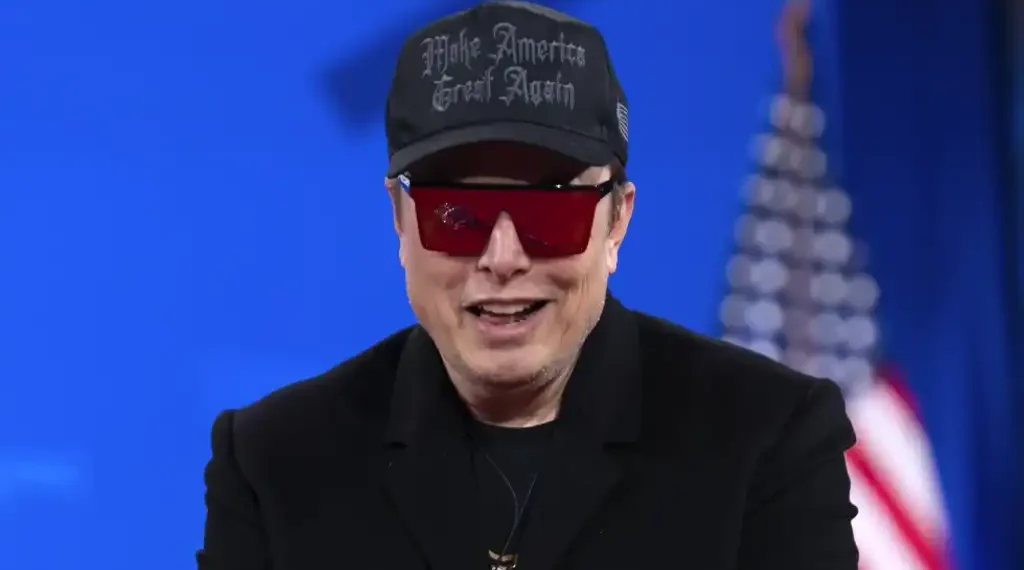

Musk’s increasing involvement in national politics, particularly his alignment with former President Donald Trump’s administration and conservative causes, has sparked controversy and impacted Tesla’s public image.

Several analysts and investors have voiced concerns about Musk’s focus being split across Tesla, SpaceX, his AI venture xAI, and political advocacy.

Dan Ives, a technology analyst at Wedbush Securities, acknowledged the concerns but believes the new compensation package may help stabilize investor sentiment:

“We believe this grant will now keep Musk as CEO of Tesla at least until 2030 and removes an overhang on the stock,” Ives said. “Musk remains Tesla’s big asset and this comp issue has been a constant concern of shareholders once the Delaware soap opera began.”

Terms of the New Stock Grant

According to the filing, Musk will be required to pay $23.34 per share when the restricted stock vests — the same exercise price outlined in the voided 2018 package. While the grant is significant, it is also structured to ensure performance-based rewards, echoing the goals of the original compensation deal.

The timing of the award also reflects Tesla’s efforts to keep Musk from being distracted or removed by shareholder activists. Musk recently stated that increasing his control over the company is essential to maintaining stability and ensuring Tesla’s future direction.

Shareholders Push for Transparency

Amid these developments, a coalition of more than 20 shareholders sent a letter to Tesla urging the company to maintain transparency and accountability. They noted the continued decline in Tesla’s stock price and called for proper notice of the upcoming annual shareholders meeting, which is now scheduled for November in compliance with Texas corporate law.

Tesla’s move to award the new grant just months ahead of the meeting could be an attempt to mitigate tension with investors ahead of potential votes on executive pay and board governance.

Musk’s Role Remains Central to Tesla’s Future

Despite the controversy, Musk remains one of the most influential figures in the tech and automotive industries. His leadership is closely tied to Tesla’s identity and innovation efforts — from self-driving technology to battery development and global expansion.

While legal and investor scrutiny may continue, Tesla appears committed to securing Musk’s presence at the helm through the end of the decade.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.