Opendoor’s Stock Rally Raises Eyebrows as Core Business Struggles

Opendoor Technologies (OPEN) stock has skyrocketed in recent weeks, jumping nearly 400% in just a month. Once seen as a struggling tech real estate company, Opendoor is suddenly back in the spotlight. But while the share price looks strong, many experts say the business itself still faces serious problems.

This article takes a closer look at what’s behind the stock surge, why Opendoor’s business model remains under pressure, and what it could mean for investors — especially if mortgage rates stay high and the housing market continues to cool.

What Is Opendoor’s Business?

Opendoor is one of the pioneers of the “iBuying” model — a real estate business that uses algorithms and data to buy and sell homes quickly for a profit.

The company offers all-cash deals to homeowners, aiming to flip properties at slightly higher prices. Using technology, Opendoor tries to identify undervalued homes, buy them fast, and resell them just as quickly.

In theory, it’s a modern and efficient way to trade real estate. But in practice, it hasn’t delivered consistent profits. Since going public, Opendoor has reported heavy annual losses — more than $300 million each year since 2021.

Other iBuyers have struggled too. Zillow and Redfin both shut down their iBuying programs in recent years, and rival Offerpad’s performance has been even worse than Opendoor’s.

Why the Stock Is Surging — But the Business Isn’t

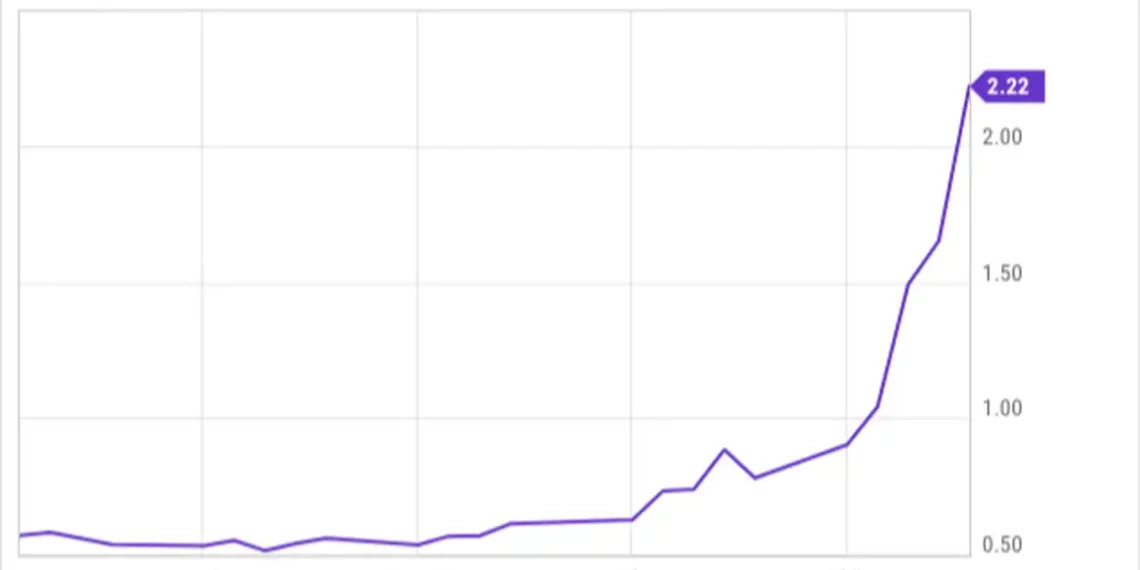

Opendoor’s share price was in trouble not long ago, trading under $1 and facing possible delisting. The company was even preparing for a reverse stock split.

Then the stock rebounded sharply, climbing almost 400% in a few weeks. Investors started hoping that falling interest rates or new business partnerships could turn things around.

But many analysts warn that the recent rally isn’t backed by real improvements in the company’s financials. In fact, Opendoor is still losing money and struggling to move its growing inventory of homes.

“If the iBuying model couldn’t make consistent profits during a housing boom, it’s hard to see it working well in a slowing market,” one analyst noted.

Growing Inventory, Slowing Sales

Opendoor’s latest earnings report shows a worrying trend: its home inventory rose to $2.4 billion in Q1 2025, up 26% from the previous quarter. That includes more than 7,000 homes, and a growing number of them are sitting unsold.

At the end of Q1, 27% of Opendoor’s homes had been on the market for over 120 days. That’s up from just 15% a year earlier.

This creates two problems:

- Stale inventory may need to be sold at lower prices.

- Unsold homes tie up company funds, preventing Opendoor from buying new ones and slowing its entire business model.

As a result, Opendoor is buying fewer homes. It had just over 1,000 homes under contract at the end of Q1 — down 60% from a year earlier.

The Bigger Challenge: A Risky Business Model

Opendoor’s iBuying strategy is based on high volume and small profit margins. But when homes sit too long or require unexpected repairs, profits can quickly disappear.

Unlike traditional real estate investors with local knowledge, Opendoor relies heavily on national data and algorithms. That can miss important details about neighborhoods or housing trends, leading to mispriced deals.

There’s also limited upside in flipping homes — you may make a modest gain if things go well, but the losses can be steep if things go wrong.

And while Opendoor is experimenting with new ideas — like partnering with local agents or changing its marketing — those fixes may not be enough to solve deeper structural problems.

What Happens Next?

The recent stock rally may give Opendoor more time to try and fix its business. The higher share price could let the company raise cash by issuing new stock, which would ease short-term funding concerns.

There’s also a chance mortgage rates could drop, which might help the housing market recover and make it easier for Opendoor to sell its current inventory.

But many investors argue there are better ways to bet on lower interest rates — such as buying stocks in homebuilders, title insurers, or companies that supply materials to the housing industry.

Final Thoughts

Opendoor’s rising stock price has caught the attention of investors and social media traders alike. But behind the headlines, the business is still facing the same issues it has for years: big losses, slow sales, and an unproven model.

If mortgage rates drop and housing demand returns, Opendoor could benefit. But for now, the risks seem high — especially compared to other companies in the housing sector.

Bottom line:

The recent rally in Opendoor stock may not reflect real progress in the company’s operations. Until the business can prove it can consistently make money, many analysts remain cautious.

For investors holding OPEN stock, this may be a good time to take profits or look at alternatives with better fundamentals.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.