Nvidia and AMD to Remit 15% of China Chip Sales to U.S. as Part of New Export Licensing Deal

Published Time: 08-11-2025, 16:00

Nvidia and AMD, two leading semiconductor manufacturers, have reached an unprecedented agreement to pay the U.S. government 15% of their revenues from chip sales in China. This arrangement, aimed at securing critical export licenses, marks a significant development in the ongoing trade and technology tensions between the two global powers.

The U.S. government previously restricted the sale of advanced chips, particularly those used in artificial intelligence (AI), to China citing national security concerns. This new deal offers a pathway for Nvidia and AMD to maintain a presence in the Chinese market while addressing those concerns through revenue sharing.

Background: U.S. Export Controls on AI Chips

In recent years, the U.S. imposed strict export controls on high-performance semiconductors designed for AI applications, such as Nvidia’s H20 chip and AMD’s MI308. These measures, initially introduced during the Trump administration and reinforced under President Biden, were intended to limit China’s access to advanced technology that could enhance its military and surveillance capabilities.

Security experts, including former officials from the Trump era, expressed particular alarm about Nvidia’s H20 chip, describing it as a “potent accelerator” of China’s AI development. The Biden administration’s 2023 export restrictions effectively barred the sale of these chips, tightening the technology chokehold on Chinese firms.

Details of the Revenue-Sharing Agreement

According to sources, Nvidia and AMD have agreed to remit 15% of their sales revenues from specific AI chips sold in China to the U.S. government. Nvidia’s obligation applies to sales of its H20 chip, while AMD’s covers revenues from its MI308 chip.

Nvidia confirmed to the BBC, “We follow rules the U.S. government sets for our participation in worldwide markets. While we haven’t shipped H20 to China for several months, we hope export control rules will allow America to compete in China and globally.” AMD did not immediately comment, and the White House declined to provide details.

This financial arrangement is considered “unprecedented,” according to Charlie Dai, Vice President and Principal Analyst at Forrester Research. He noted that it illustrates the increasing cost and complexity for technology companies seeking access to the Chinese market amid intensifying U.S.-China trade frictions.

Industry and Political Reactions

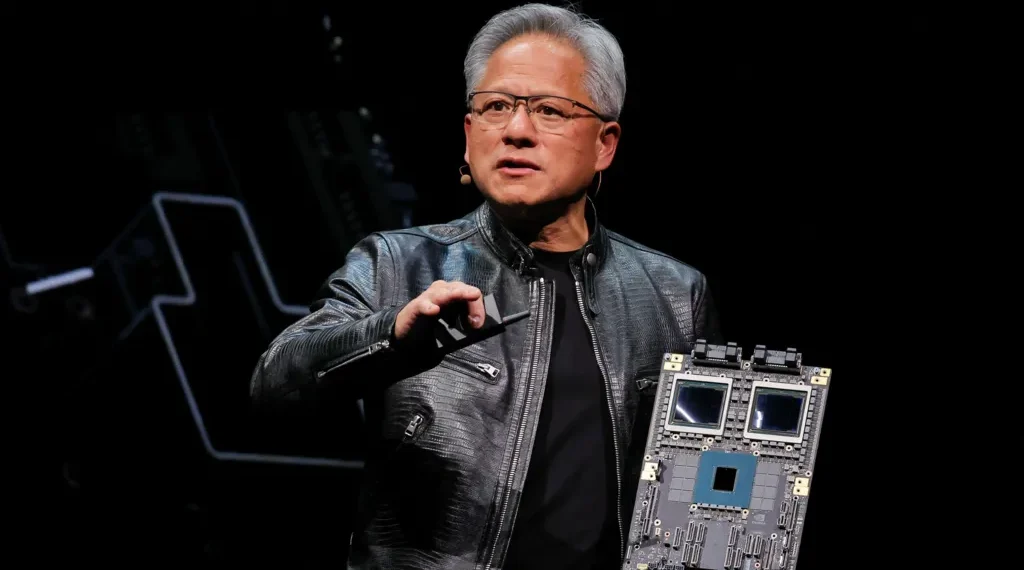

Nvidia CEO Jensen Huang has actively lobbied U.S. policymakers to ease export restrictions, including a recent meeting with former President Trump. Huang emphasized the need for the U.S. to remain competitive in global AI technology markets.

Trade policy expert Deborah Elms of the Hinrich Foundation remarked, “You either have a national security problem or you don’t. Charging a 15% fee doesn’t eliminate the security risks associated with exporting these chips.”

From Beijing, the Ministry of Foreign Affairs reiterated China’s opposition to what it calls “unilateral bullying” and misuse of export controls by the U.S. government. A letter signed by 20 security specialists to U.S. Commerce Secretary Gina Raimondo warned that AI-optimized chips, while often purchased by civilian firms, are likely to be used by the Chinese military for autonomous weapons and intelligence applications.

Broader Context: Easing Trade Tensions and Strategic Stakes

The deal to resume chip sales comes amid a slight easing of trade tensions between the U.S. and China. Recent months have seen Beijing ease restrictions on rare earth exports, and Washington lift certain controls on chip design software companies operating in China.

In May, both nations agreed to a temporary 90-day truce in their tariff disputes, though the extension of this pause remains uncertain as a key August deadline approaches.

The trade strategy of former President Trump emphasizes encouraging domestic investments. Recently, major American companies have announced substantial U.S.-based investments: Apple pledged an additional $100 billion, and Micron Technology committed $200 billion, including new manufacturing facilities. Nvidia also plans to invest up to $500 billion to develop AI supercomputers made entirely in the U.S.

Meanwhile, political tensions persist, exemplified by Trump’s public call for Intel CEO Pat Gelsinger’s resignation due to alleged ties to Chinese entities — a claim Gelsinger denies as misinformation.

Conclusion

The agreement requiring Nvidia and AMD to share a portion of their China revenues with the U.S. government reflects the intricate balance between economic interests and national security concerns in the current global technology landscape. As U.S.-China relations remain delicate, this deal underscores both the financial and strategic complexities tech companies face in navigating geopolitical restrictions while striving to remain competitive worldwide.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.