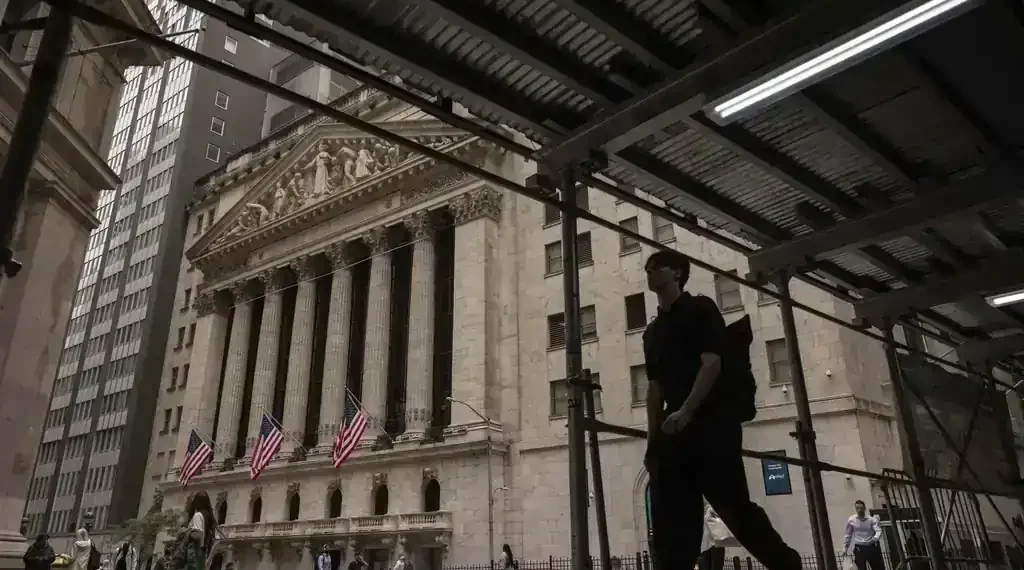

Markets Wobble as Investors Wait on Trump’s Decision About War with Iran

Wall Street is showing cautious optimism following the Juneteenth holiday, with U.S. stocks ticking slightly higher and Treasury yields edging up. But behind the mild gains, investors are holding their breath — waiting to see if President Donald Trump will pull the U.S. directly into the escalating conflict between Israel and Iran.

Trump said he plans to make a decision within the next two weeks on whether the U.S. military will become directly involved in the fighting — a move that could rattle global markets and reshape the geopolitical landscape.

Global Markets React, Oil Prices Rise

While world shares mostly climbed in Thursday trading, oil prices rebounded, reflecting persistent fears of a wider war disrupting the global supply of crude.

- U.S. benchmark crude rose 52 cents to $75.66 per barrel

- Brent crude, the global standard, added 31 cents to $77.01 per barrel

Analysts say these modest increases reflect market unease. As the threat of a broader regional war lingers, oil traders are factoring in potential supply disruptions — even as the conflict remains contained for now.

Risk Is Being Repriced

According to Stephen Innes of SPI Asset Management, markets are undergoing a mindset shift. In a note to investors, he warned:

“The stock market’s risk premium isn’t just rising — it’s recalibrating for a world where every macro lever now doubles as a tripwire.”

In other words, traders aren’t just nervous — they’re preparing for a new reality where global politics and market volatility are more closely entwined than ever.

Trump’s Tariff Agenda Still Lurks in the Background

Even as headlines are dominated by war talk, Trump’s trade and tariff policies continue to cast a long shadow over the markets. Innes described the ongoing uncertainty around tariffs as:

“A delayed fuse is still a fuse.”

While it’s not the focus of the moment, any movement on tariffs — especially if paired with military escalation — could ignite fresh market turbulence.

The Bottom Line

Investors are in wait-and-see mode, and the next two weeks could prove pivotal. A decision by Trump to enter the Israel-Iran conflict militarily would not only heighten global tensions but likely trigger a swift reaction in energy prices, defense stocks, and broader financial markets.

For now, markets are climbing — cautiously. But with war and trade both simmering just beneath the surface, calm could be short-lived.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.