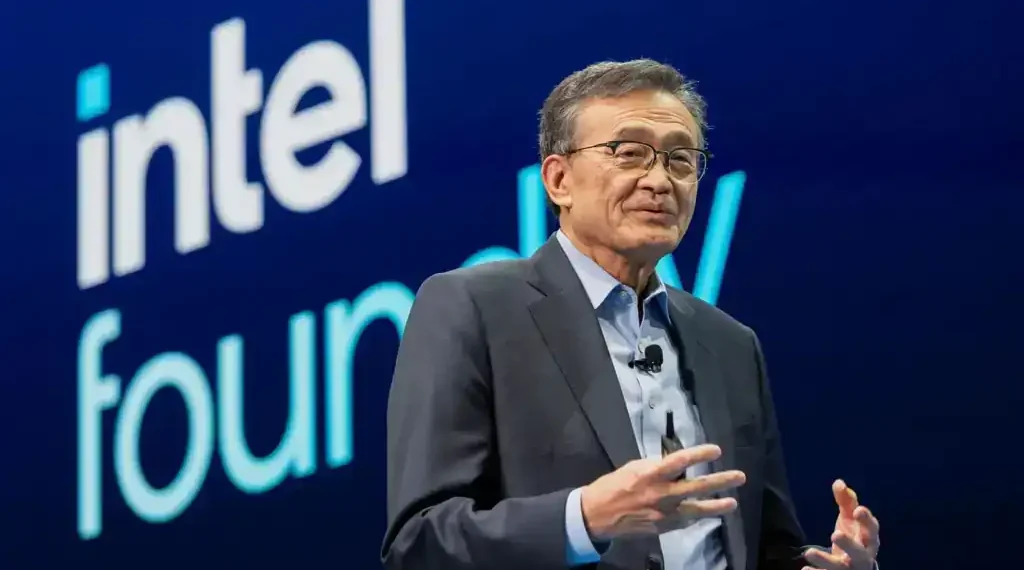

Intel Shares Slide as Trump Urges CEO Lip-Bu Tan to Resign Over China Ties

Writing Time: August-07-2025, 14:00 (U.S. Eastern Time)

Intel Corporation is facing fresh political heat after former U.S. President Donald Trump publicly called for the resignation of CEO Lip-Bu Tan. The demand, issued via Trump’s social media platform Truth Social, sparked a dip in Intel’s stock price and renewed scrutiny over Tan’s business associations with Chinese companies.

Amid broader concerns over national security and corporate transparency, lawmakers are also questioning Tan’s past investments and leadership decisions, signaling growing tensions between U.S. tech interests and geopolitical risk.

Trump Calls Intel CEO “Highly Conflicted”

On Thursday, Intel shares slipped following a Truth Social post from former President Donald Trump targeting CEO Lip-Bu Tan. Trump claimed that Tan was “highly CONFLICTED” and stated bluntly that “there is no other solution to this problem” than for Tan to resign immediately.

Intel has not issued an official response to Trump’s comments as of this writing. The abrupt criticism marks a significant escalation in political pressure on one of the most prominent leaders in the U.S. semiconductor industry.

Tan was appointed as Intel’s CEO in March 2025, succeeding Pat Gelsinger. His arrival was positioned as a strategic shift during a time when the company was trying to recover from declining sales, missed production timelines, and increased global competition.

Senator Cotton Raises National Security Concerns

Adding to the political backlash, Senator Tom Cotton (R-Ark.) this week sent a letter to Intel’s board chair voicing concern over Tan’s business ties in China. Cotton’s letter emphasized the potential national security risks posed by Tan’s past investments in Chinese companies, including those with reported links to the Chinese Communist Party (CCP) and the People’s Liberation Army (PLA).

“Intel is required to be a responsible steward of American taxpayer dollars and to comply with applicable security regulations,” Cotton wrote. “Mr. Tan’s associations raise questions about Intel’s ability to fulfill these obligations.”

Senator Cotton’s letter further pressed Intel to disclose whether it required Tan to divest any holdings in companies affiliated with sensitive Chinese entities, particularly those involved in defense or surveillance technologies.

Tan’s Investment History Draws Scrutiny

According to a Reuters report published in April, Tan has invested in multiple Chinese technology firms—either directly or via venture capital funds. Some of these entities have reported links to China’s military-industrial complex.

Before joining Intel, Tan served as CEO of Cadence Design Systems until 2021. During that time, the company was reportedly connected to a criminal case, which further complicates the current political optics.

While no wrongdoing has been officially attributed to Tan in this context, the optics of his connections are increasingly being viewed as a liability at a time when the U.S. is focused on tightening controls over tech investments tied to foreign adversaries.

Intel’s Recent Financial Moves and Cost-Cutting Strategy

Despite beating Wall Street’s expectations in its second-quarter earnings report, Intel has been undergoing significant restructuring aimed at reducing operational losses and focusing on core growth areas.

In July, Tan confirmed major spending cuts, including:

- Slashing costs in Intel’s foundry business, which reported an operating loss of $3.17 billion

- Canceling fabrication plant projects in Germany and Poland

- Consolidating operations in Vietnam and Malaysia

- Delaying construction of a new chip manufacturing plant in Ohio

These moves reflect Intel’s effort to streamline its global supply chain while navigating economic uncertainty, changing market demand, and international political pressure.

Tensions Between U.S. Tech and Geopolitics Escalate

Tan’s situation exemplifies the growing intersection of tech leadership and national security. The U.S. government has taken a more aggressive stance in recent years to prevent American innovation and capital from supporting entities deemed adversarial or high-risk.

In 2023, the Biden administration expanded restrictions on the export of advanced semiconductors and chipmaking equipment to China. In this context, having a CEO with financial or professional links to Chinese firms raises complex compliance and political concerns—even if no direct legal violations have occurred.

Intel, as one of the largest recipients of U.S. federal incentives through the CHIPS and Science Act, is under increased scrutiny to ensure that its leadership and operations align with U.S. national interests.

What’s Next for Intel and Lip-Bu Tan?

As of now, there is no confirmation that Intel’s board is considering Tan’s removal. However, with high-profile figures like Trump and Senator Cotton calling for action, the pressure is likely to mount.

How Intel navigates the situation—through transparency, public reassurance, or leadership decisions—may shape investor confidence and regulatory responses in the weeks ahead.

For now, Intel’s share price dip reflects not only market reaction to Trump’s statement but also broader concerns about corporate governance, international influence, and strategic technology leadership.

Final Thoughts

The controversy surrounding Lip-Bu Tan underscores the fragile relationship between Silicon Valley and Washington D.C.. As semiconductors remain at the center of the global tech race, executive backgrounds and corporate partnerships are being scrutinized more than ever.

Intel’s future leadership stability will depend not only on performance and innovation but also on how well it aligns with national priorities and geopolitical realities.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.