Circle K’s partnership with crypto ATM operators has generated steady revenue but drawn scrutiny as police, regulators, and victims link the machines to widespread fraud.

The machines police keep responding to

At a Circle K store in Niceville, Florida, a district manager stared at a cryptocurrency ATM near the entrance after police responded to yet another fraud complaint. An elderly customer had just deposited thousands of dollars into the machine after following instructions from a scammer.

“I hate these machines,” the manager told officers, according to police body-camera footage from September. “I’d like to get them out of the stores.”

Similar scenes have played out across the country. Law enforcement agencies say victims—often retirees living on fixed incomes—are being directed by scammers to crypto ATMs, where cash can be quickly converted into digital currency that is difficult, if not impossible, to recover.

Losses mounting nationwide

According to federal data, Americans lost more than $330 million to crypto ATM scams between January and November this year, with more than 12,000 complaints reported to the FBI. The losses reflect a sharp rise in fraud tied specifically to these machines, which allow near-instant transfers to digital wallets that are frequently based overseas.

A joint investigation by CNN and the International Consortium of Investigative Journalists found that Circle K stores featured prominently in those cases. Reporters reviewed more than 150 police reports involving crypto ATM scams at Circle K locations and interviewed 17 current and former employees who said they regularly witnessed fraud inside their stores.

Several employees said they had tried to intervene, sometimes successfully, while others described feeling powerless as customers followed scammers’ instructions over the phone.

A lucrative partnership

Circle K is one of the largest corporate partners of Bitcoin Depot, a major crypto ATM operator. Records reviewed by CNN and ICIJ show that more than 750 Circle K locations host Bitcoin Depot machines, part of a broader network of more than 30,000 crypto ATMs operating in retail spaces nationwide.

The arrangement provides Circle K with rental income for the floor space the machines occupy. People familiar with the deal said the company initially earned as much as $700 per month per location, with payments later reduced but still generating hundreds of dollars monthly at many stores.

Bitcoin Depot has promoted such partnerships as “zero risk” revenue opportunities for retailers, while also promising increased foot traffic.

Employees caught in the middle

Store workers say the reality has been far more complicated. Several employees told investigators that scams have become so frequent they recognize warning signs immediately—older customers on the phone, bank envelopes in hand, or visible confusion as they approach the machines.

In Port Orange, Florida, assistant manager Debbie Joy said she has intervened in at least 10 suspected scams. She has the phone number of a local police investigator saved in her contacts.

“It’s usually an older or elderly person on the phone with someone,” Joy said. “It’s sad, really.”

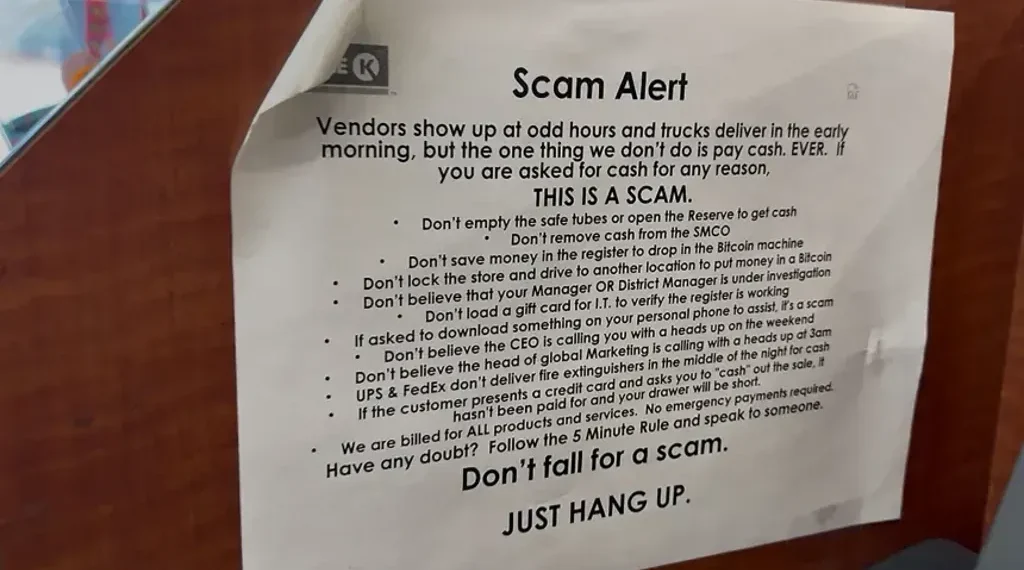

Police reports also show that Circle K employees themselves have been targeted. In multiple cases, scammers impersonating corporate officials or delivery services persuaded staff to remove cash from store safes and deposit it into crypto ATMs.

Circle K’s response

Circle K says it does not own or operate the crypto ATMs in its stores and does not oversee customer transactions. In a statement, a company spokesperson said employees receive training on common scams but are not responsible for third-party machines.

“While we train and educate our employees to recognize common and emerging financial scams, they do not handle or oversee customer transactions at self-service cash ATMs or Bitcoin Depot terminals available in our stores,” the spokesperson said.

The company added that cryptocurrency scams typically begin before victims enter retail locations and that Circle K works with partners to ensure regulatory compliance.

Despite the ongoing concerns, Circle K renewed its contract with Bitcoin Depot earlier this year, extending the partnership by one year.

How scammers exploit the machines

Investigators say crypto ATMs are particularly attractive to fraudsters because transactions are fast and irreversible. Scammers often pose as tech support agents, law enforcement officers, government officials, or even political figures.

In one Florida case cited in police reports, an 86-year-old woman told officers she believed she was sending money to cover campaign-related debts after communicating with someone online. Officers later warned her the request was almost certainly fraudulent.

In Prescott, Arizona, at least a dozen victims reported losses tied to a single crypto ATM inside a Circle K, according to local records.

Legal pressure and limited recourse

Victims who attempt to recover lost funds face steep challenges. Courts have often ruled that crypto ATM operators are not liable when users bypass warnings or terms of service.

One South Carolina widow who lost $30,000 at a Circle K-hosted crypto ATM sued both Bitcoin Depot and the store operator, arguing that the risks were well known and that staff failed to intervene. A federal judge later directed the case to arbitration, citing the machine’s user agreement.

Bitcoin Depot says arbitration provisions are intended to resolve disputes efficiently and that the company maintains fraud warnings, ID requirements, and cooperation with law enforcement.

Other retailers pull back

Not all businesses have chosen to continue hosting the machines. Several retailers have removed crypto ATMs after reporting repeated scams and police interventions.

A Midwest grocery chain temporarily shut down its machines after executives warned they were becoming “instrumentalities of fraud,” according to court filings. The dispute ended in a legal settlement, and Bitcoin Depot said the matter has since been resolved.

Small business owners have voiced similar concerns, with some saying nearly every crypto ATM transaction they observed involved a scam victim.

Regulation tightens

State lawmakers have increasingly targeted crypto ATM fraud. Since 2023, at least 18 states have enacted laws or regulations imposing daily transaction limits, mandatory warnings, or refund requirements for victims.

Bitcoin Depot has warned investors that these measures could significantly reduce revenue, and company executives have indicated they may withdraw machines from states with stricter rules.

Circle K’s current agreement with Bitcoin Depot is set to expire next year, and the company has not said whether it plans to renew.

Trust eroded

For many victims, the presence of crypto ATMs inside familiar stores added a layer of credibility that scammers exploited.

“You think everything in a convenience store is for your convenience,” said one retiree who lost thousands of dollars after being directed to a Circle K.

Others say the experience permanently changed how they view the brand.

“Every time I pass that store, I get a strange feeling,” said an Indiana man who lost $1,200. “I don’t want to go back in.”

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.