More Workers Embrace Polyworking Amid Stagnant Wages and Inflation Pressures

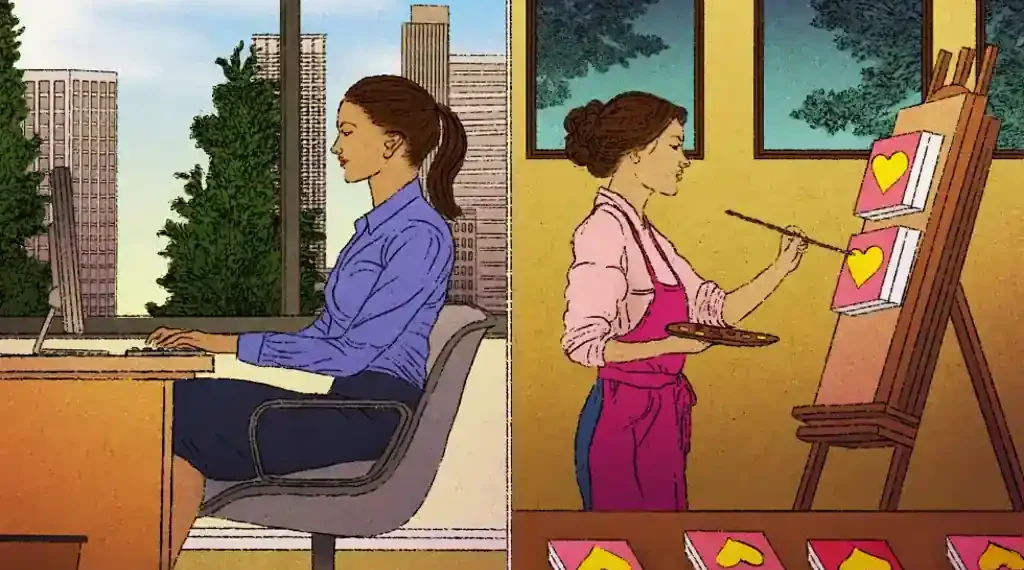

Workers across the United States are taking on a growing mix of side jobs as stagnant salaries, persistent inflation, and fears of layoffs reshape household budgets. Many are building “portfolio careers,” combining traditional employment with gig work, freelance projects, or passion-driven ventures. Experts say the trend reflects a broader shift in how people manage financial risk and career development.

Why Polyworking Is On the Rise

The practice of holding two, three, or even four jobs has become increasingly visible as living costs rise faster than salaries. Economists note that wage growth for many workers has flattened over several years, while inflation and housing expenses continue to outpace earnings, according to data from the U.S. Bureau of Labor Statistics.

Researchers say this financial pressure is encouraging people to diversify their income streams rather than depend on a single employer. Alexandrea Ravenelle, a sociologist at the University of North Carolina at Chapel Hill who studies the gig economy, said the combination of rising expenses and economic uncertainty has prompted workers to create their own safety nets.

“We’ve seen stagnant salaries and the cost of living increasing, even beyond standard inflation measures,” she said. “People are looking for ways to supplement and protect themselves.”

A Growing Trend Among Younger Professionals

Many workers now seek side roles that align with personal interests or skills. For 29-year-old Katelyn Cusick in California, polyworking evolved into a mix of creative and professional pursuits.

Cusick works full-time as a visual merchandiser for Patagonia, but also manages influencer marketing for a German shoe company, runs an Etsy shop for her artwork, and ushers at local concerts. The varied schedule, she said, brings both financial stability and personal fulfillment.

“Every day feels different, and that’s why I started doing these side hustles,” she said. “I didn’t want to do the same thing every day.”

Although the motivations vary, many workers say that additional income helps cover student loan payments, rising rent, and other essential expenses.

The Rise of “Portfolio Careers”

Career advisers say the shift represents a broader rethinking of professional growth. Rather than following a single, linear career path, more people are developing multiple skill sets across several jobs.

Elaine Chen, director of the Derby Entrepreneurship Center at Tufts University, said workers increasingly view secondary roles as opportunities to test new skills or strengthen areas that may not be part of their primary job.

“Some people are putting together multiple side hustles based on their abilities and interests, building multiple revenue streams,” she said.

For some, these roles can enhance long-term career resilience by creating a more diverse professional profile.

Following a Passion While Earning Income

Experts advise that workers considering a side role choose something they genuinely enjoy, given the time commitment required. A passion-driven approach also helps maintain motivation during long hours.

In Salt Lake City, 31-year-old fundraiser Josie White pursued public speaking as a secondary career after finding effective treatment for schizoaffective disorder. She wanted to share her experience to support others facing mental health challenges.

While working full-time at a nonprofit, she began speaking at conferences and workshops, initially as a volunteer to build experience. She has since booked multiple engagements, with several now paid.

“The goal is ultimately to get paid,” she said. “Right now I’m putting in the legwork to reach that.”

Understanding the Financial Reality

Launching a side business can require initial investments, whether in training, marketing, supplies, or equipment. Experts caution that it may take months or more before income becomes steady.

White reinvests her speaking fees into skill development, emphasizing that growth can be slow at first. Career advisers recommend building realistic timelines and budgets before committing to a secondary venture.

The Realities of Gig Work

Some workers turn to gig platforms such as Uber, Instacart, or Grubhub because they offer quick income and flexible scheduling. However, researchers warn that gig work can come with long-term career risks.

Tom Ritter, 39, from Syracuse, New York, used delivery apps to supplement his full-time job in workforce management. When he recently lost his primary job, gig work helped him cover immediate expenses.

“Even that extra couple hundred dollars a month went a long way,” he said.

But Ravenelle cautions that heavy reliance on gig work can make it harder to transition back to stable, salaried employment. She also notes that algorithm changes on platforms can reduce earnings without warning.

“The house always wins when it comes to gig platforms,” she said.

Avoiding Scams and Unrealistic Promises

The rapid growth of the side-hustle economy has also attracted misleading online schemes. Some influencers promote business ideas that promise high returns but are designed to profit primarily from course fees, supplies, or memberships.

Ravenelle said she has interviewed workers who invested in growing microgreens at home after watching videos claiming they could earn thousands selling to restaurants. In many cases, the only people making substantial money were those selling the equipment and training.

Experts advise researching thoroughly, seeking independent reviews, and avoiding opportunities that promise quick profits with minimal effort.

Balancing Time and Well-Being

Juggling multiple jobs can significantly reduce personal time, limiting opportunities for rest, exercise, or social activities. Workers with portfolio careers often report long hours and fragmented schedules.

White works four long days each week at her nonprofit and devotes Fridays to building her speaking business. Although her schedule is demanding, she finds purpose in her work.

“I wouldn’t describe my life as balanced,” she said. “But am I enjoying it? Yes. And I think that matters.”

Experts recommend setting boundaries, planning regular downtime, and prioritizing health to avoid burnout.

Conclusion

The rise of polyworking reflects broader shifts in the labor market, where economic pressures and evolving career expectations drive workers to diversify their income. While the lifestyle can provide financial security and personal growth, experts emphasize the importance of realistic planning, careful research, and balancing workload with well-being.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.