Wall Street Surges to Record Highs Despite Ongoing U.S. Government Shutdown

October 5, 2025, 21:00 EDT

Market Momentum Persists Despite Washington Paralysis

NEW YORK — The U.S. government shutdown has failed to shake Wall Street’s confidence. Even as federal agencies pause key economic reports, stock indexes continue to climb, defying the uncertainty surrounding Washington’s budget impasse.

On Friday, the S&P 500 and Dow Jones Industrial Average both closed at all-time highs, underscoring investor optimism that has swept through nearly every sector. The rally extended beyond the usual Big Tech leaders, with smaller-cap stocks, gold, and major bond funds all advancing sharply in tandem.

The Russell 2000 index, a benchmark for smaller companies, reached a new record for the first time in nearly four years. Gold prices hit historic highs as well, while the largest U.S. bond fund is on track for its strongest performance in at least half a decade.

According to analysts, the market’s resilience reflects expectations that the shutdown’s economic impact will be limited — much like during previous standoffs. The broader bet on Wall Street is that the rally still has room to run, even after a 35% surge since April’s lows.

Valuations Raise Eyebrows Amid Rapid Gains

Despite record-breaking performance, growing concerns are emerging about overheated valuations. Stock prices have risen much faster than corporate earnings, fueling debate over how long the rally can last.

A valuation measure developed by Nobel laureate Robert Shiller, which tracks average corporate profits over a decade, now places the S&P 500 near its most expensive level since the 2000 dot-com bubble. Some analysts have drawn comparisons between that era’s speculative mania and the current enthusiasm for artificial intelligence.

Ann Miletti, head of equity investments at Allspring Global Investments, noted the steep rise in speculative small-cap and unprofitable firms. “It’s these little bubbles that are concerning to me,” Miletti said. “When you see things like this, it’s generally not a good thing.”

Still, high valuations alone have rarely been accurate predictors of turning points. As long as investors are willing to pay premium prices, analysts say stocks can stay “expensive” for extended periods — a lesson learned many times in the past decade.

Earnings Season Looms as a Key Test

The upcoming corporate earnings season is likely to determine whether the rally’s foundation remains solid. Analysts expect S&P 500 companies to post year-over-year earnings growth of around 8%, according to data from FactSet.

Major corporations including PepsiCo and Delta Air Lines will kick off reporting this week, followed by JPMorgan Chase and other leading banks. Investors are watching closely to see if companies not only meet profit expectations but also project continued growth into 2026.

However, persistent inflation, new tariffs, and broader economic uncertainty could complicate the picture. Many firms are still adjusting to shifting trade policies and fluctuating consumer demand, leaving analysts cautious about the sustainability of earnings momentum.

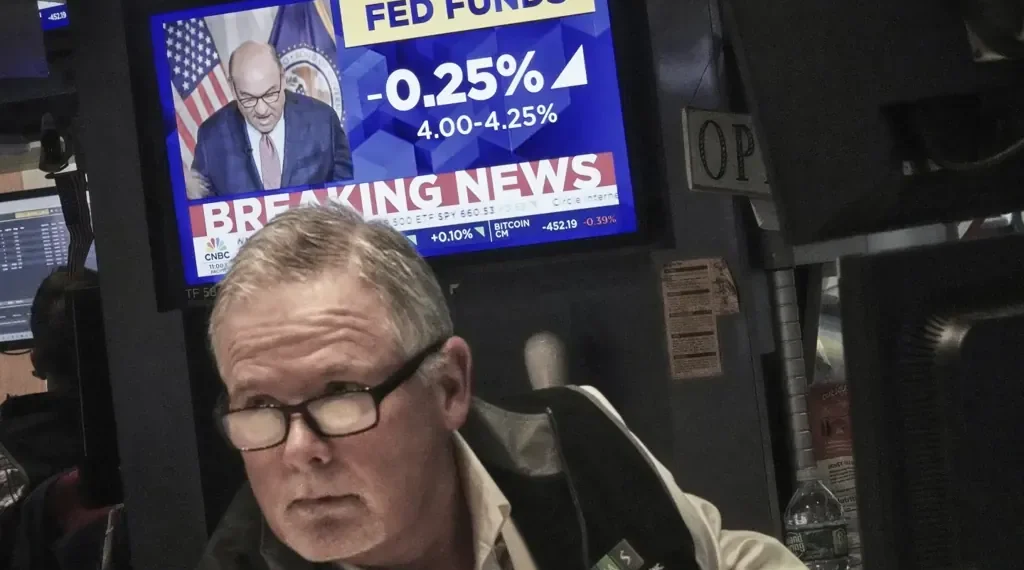

All Eyes on the Federal Reserve’s Next Move

One of the strongest drivers of the recent rally is investor confidence that the U.S. Federal Reserve will begin a cycle of interest rate cuts in the coming months.

Lower borrowing costs typically encourage consumer spending and business investment while boosting valuations for stocks and bonds. Traders currently expect at least three Fed rate cuts by mid-2026, according to data from the CME Group.

Fed officials, however, have remained noncommittal. Chair Jerome Powell has acknowledged signs of a cooling job market but warned that inflation remains above the central bank’s 2% target. If inflation stays elevated, rate cuts may be smaller or slower than markets expect.

“I feel like interest rates and expectations of what the Fed is going to do are driving everything right now,” said Miletti. “If the Fed doesn’t cut as much as people are expecting, the speculative parts of the market could face real problems.”

Artificial Intelligence: The Decade’s Defining Question

Beyond rates and earnings, optimism surrounding artificial intelligence continues to shape market sentiment. Yung-Yu Ma, chief investment strategist at PNC Asset Management Group, said that while AI-related stocks have surged dramatically, valuations remain reasonable if the sector’s rapid growth continues.

“AI will need to make the economy more productive in order to offset inflation and rising debt,” Ma said. “If we achieve these benefits for companies and for people’s lives, everything can go well for years.”

AI enthusiasm has also helped temper concerns about long-term inflation and borrowing costs, with many investors betting that technological gains will eventually enhance productivity across industries.

Outlook: Resilience Meets Risk

For now, Wall Street remains buoyant, supported by expectations of strong profits, policy easing, and long-term technological transformation. Yet risks remain — from stubborn inflation and global debt to pockets of speculation across smaller companies.

As history has shown, markets can defy gravity longer than expected, but sustained growth will depend on whether earnings and productivity eventually justify the optimism. Until then, investors appear content to keep betting that this rally has more room to run.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.