Bitcoin Nears $100,000 with Nearly 40% November Gain

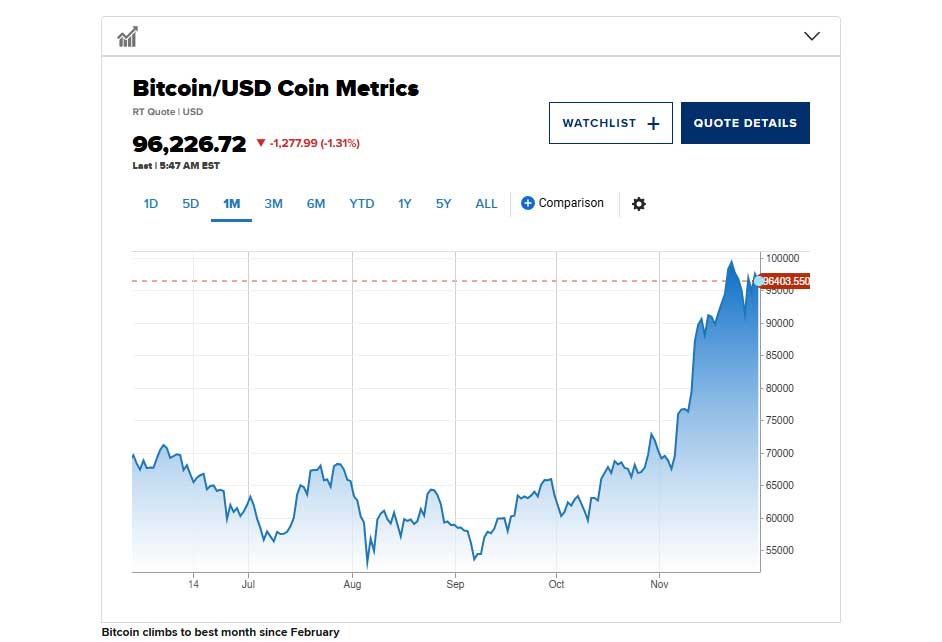

Bitcoin is having one of its best months of the year, tracking a nearly 40% gain for November. This impressive surge follows a series of record-breaking price moves, largely fueled by the election of former President Donald Trump. The cryptocurrency has seen a dramatic rise, bringing it close to the $100,000 mark for the first time in recent months.

According to Coin Metrics, Bitcoin is on track for a 38% gain in November, making it the best-performing month since February, when it gained 45% after the launch of spot bitcoin ETFs. At the end of the month, Bitcoin was trading around $97,081, with earlier peaks reaching $98,722.

Trump’s Election Victory Fuels Bitcoin Surge

Bitcoin’s rise in November was strongly tied to the anticipation of a second Trump presidency. During his campaign, Trump presented himself as a champion for the cryptocurrency industry, promising to bring clarity and stability after a period of regulatory uncertainty. This optimism from investors led to Bitcoin’s surge toward $100,000.

A potential second term for Trump is seen as a positive catalyst for Bitcoin, boosting the crypto market’s legitimacy. His presidency could lead to larger budget deficits, higher inflation, and changes in the global role of the U.S. dollar—factors that tend to support Bitcoin’s price.

Bitcoin ETFs and Institutional Interest

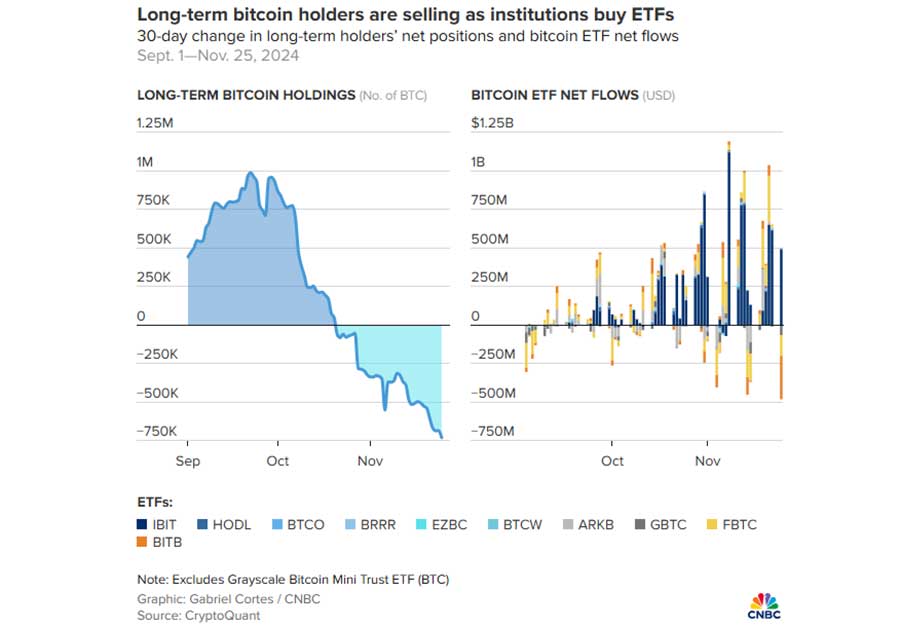

After Trump’s election victory, Bitcoin ETFs, particularly BlackRock’s popular IBIT fund, saw massive inflows. This fueled further demand, even as some long-term Bitcoin holders sold off their positions to take profits. The introduction of Bitcoin ETF options also created new ways for investors to trade and speculate on the cryptocurrency’s price.

Long-term Bitcoin holders have been selling while institutional investors, including those backing ETFs, have been buying. This shift reflects growing interest in Bitcoin as an investment, with many institutions using it as part of their portfolio.

Looking Ahead: Bitcoin’s Price Could Reach $100,000 by Year-End

Bitcoin bulls are optimistic about its future, with many predicting it will hit $100,000 by the end of 2024. Some even expect the price to double by the end of 2025. Although Trump’s victory sparked an immediate price boost, analysts believe Bitcoin’s fundamentals—such as the reduction in supply from this year’s halving and the growing institutional demand—will continue driving the price higher in the long term.

Bitcoin’s price cycles typically peak about a year after each halving event, meaning the best may be yet to come. As more institutions, states, and countries consider Bitcoin a treasury reserve asset, demand is expected to push the price even higher.

Top picture credit: CryptoQuant|Bloomberg|Getty Images

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.