Treasury Reclassifies Tax Credits, Could Limit Benefits for Immigrant Taxpayers

The U.S. Treasury Department plans to redefine certain refundable tax credits as “federal public benefits.” This change may restrict access for some immigrant taxpayers. Critics warn it could affect DACA recipients, Temporary Protected Status (TPS) holders, and other legally authorized workers, even if they pay taxes. The move may also expand immigration enforcement measures.

Proposed Changes to Tax Credit Eligibility

The Treasury’s draft rule would classify refundable portions of several tax credits—including the Earned Income Tax Credit, Additional Child Tax Credit, American Opportunity Tax Credit, and Saver’s Match Credit—as federal public benefits under the 1996 Personal Responsibility and Work Opportunity Reconciliation Act.

If enacted, eligible immigrants with U.S. work authorization might no longer qualify for these benefits. Foreign students, temporary workers, and families with U.S.-citizen children could also be affected, depending on how the rule is finalized.

Impact on Immigrant Taxpayers

The Tax Policy Center reports that undocumented immigrants contributed nearly $100 billion to federal, state, and local taxes in 2022. Despite these payments, they are often ineligible for benefits like Social Security or Medicare.

Experts warn the new rule could extend these restrictions to legally authorized immigrants who pay taxes. Carl Davis, research director at the Institute on Taxation and Economic Policy, said the policy would target “people who are really trying to do the right thing,” making life harder for taxpaying immigrants.

Criticism from Policy Experts

Daniel Costa, director of Immigration Law and Policy Research at the Economic Policy Institute, called the proposal “terrible and unfair,” arguing it penalizes immigrants contributing to the U.S. tax system.

Brandon DeBot, policy director at NYU’s Tax Law Center, added that denying tax credits to immigrant families requires explicit congressional approval. He said the Treasury’s reinterpretation “overrides clear provisions of the tax code.” Analysts suggest the administration may bypass Congress because such a policy likely would not gain majority support.

Administration’s Justification

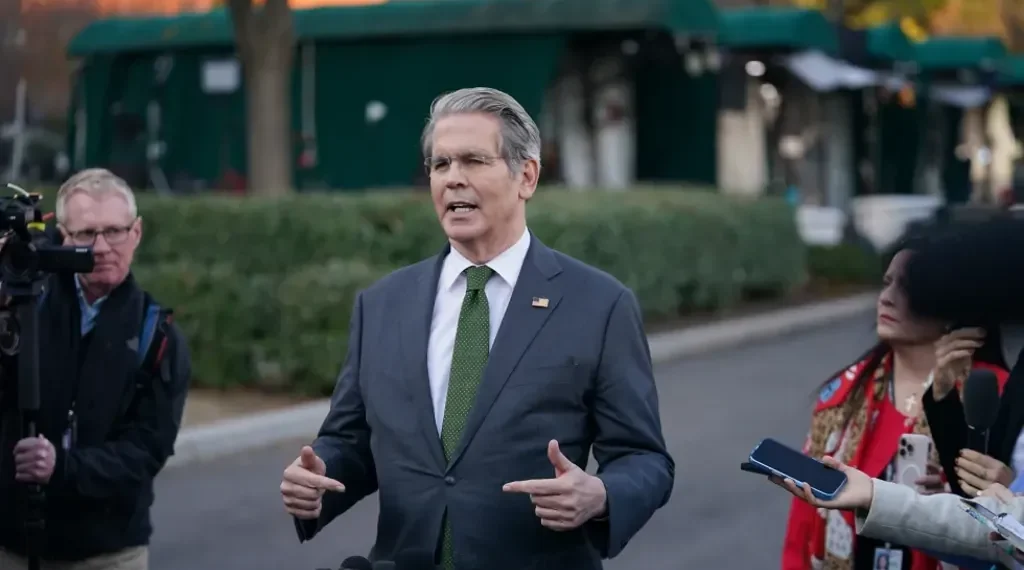

Treasury Secretary Scott Bessent said the rule enforces the law by “preventing illegal aliens from claiming tax benefits intended for American citizens.” The Treasury consulted with the Justice Department to reinterpret the statutes and craft the proposed regulation.

The change aligns with the Trump administration’s broader immigration enforcement strategy, which increasingly involves multiple federal agencies beyond Homeland Security. The final rule is expected to take effect in the 2026 tax year.

Broader Context

Critics argue the approach is a roundabout way to target immigrants, particularly DACA and TPS recipients, who are generally viewed sympathetically by the public. Analysts note it could expand administrative monitoring of immigration status and increase deportation risk, even for authorized workers.

The policy has raised concerns among tax experts and immigrant advocates, highlighting tensions between federal tax administration, immigration enforcement, and social equity.

Follow JournosNews.com for professionally verified reporting and expert analysis across world events, business, politics, technology, culture, and health — your reliable source for neutral, accurate journalism.

Source: AP News – Treasury plans to change tax credit eligibility in a move critics say will hurt immigrant taxpayers

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.