AI Voice Cloning Threatens Bank Security, Warns OpenAI CEO Sam Altman

AI Can Now Fool Voice Authentication, Altman Tells Federal Reserve

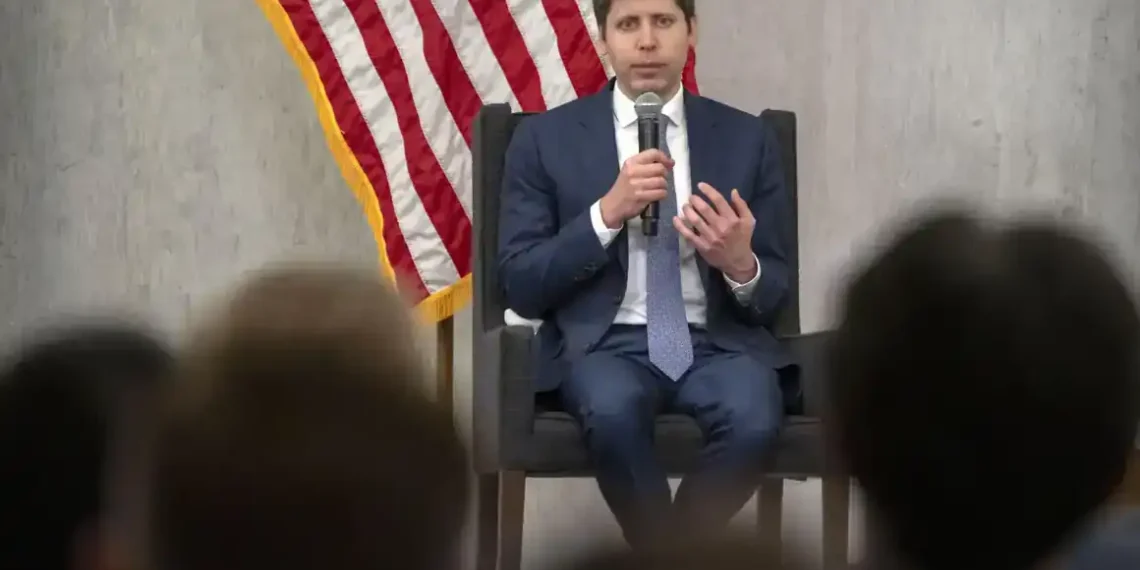

OpenAI CEO Sam Altman has raised a serious warning about artificial intelligence and banking security. During a Federal Reserve conference in Washington, D.C., Altman said AI tools are now good enough to fake someone’s voice — and could soon trigger a wave of financial fraud.

He called this threat a “significant impending fraud crisis,” especially for banks that still use voiceprints to verify clients. Altman’s warning comes as AI technology becomes more advanced and harder to detect, prompting calls for updated fraud protections.

AI Can Imitate Voices Too Well

Altman didn’t hold back during his talk. He pointed out that some financial institutions still rely on voice authentication — a system where users speak a set phrase over the phone to access their accounts.

“That is a crazy thing to still be doing,” he said. “AI has fully defeated that.”

In other words, artificial intelligence has gotten so good at mimicking human voices that it can now trick banks into giving access to accounts, just by faking someone’s voice.

Why Voiceprint Security Is No Longer Safe

Voiceprint authentication became popular over a decade ago, especially for wealthy clients who wanted a quick way to access accounts by phone. Instead of passwords or PINs, they would speak a phrase that the bank used to identify them.

But Altman made it clear: that kind of security no longer works in the age of AI.

AI-powered tools can now take a short recording of someone’s voice — from a phone call, social media post, or video — and create a high-quality voice clone that sounds just like the real person. These fake voices can even say things the person never said.

It’s not just about voice, either. Altman warned that video impersonations are next, and may also become indistinguishable from real footage.

Banks Urged to Rethink Security

The warning didn’t fall on deaf ears. Michelle Bowman, the Federal Reserve’s Vice Chair for Supervision, hosted the talk and responded directly to Altman’s concerns.

“That might be something we can think about partnering on,” Bowman said, referring to how regulators and AI leaders like Altman might work together to create stronger protections for financial institutions and their customers.

Her response suggests that the Federal Reserve may start re-evaluating how banks handle identity verification in the near future.

What’s at Risk?

The growing power of AI voice cloning poses big risks to consumers, especially in sectors like banking, finance, and customer support, where voice-based security is still in use.

If criminals can use AI to mimic someone’s voice, they could:

- Access private bank accounts

- Transfer large amounts of money

- Bypass customer service identity checks

- Commit fraud without being detected right away

Altman’s warning suggests this isn’t just a future problem — the technology already exists and is improving fast.

What’s Next for AI and Security?

The financial industry now faces pressure to upgrade security systems to stay ahead of AI threats. Experts say banks may need to:

- Move away from voiceprint systems

- Use multi-factor authentication (such as biometrics or security keys)

- Monitor for suspicious account activity in smarter ways

- Work closely with AI companies to understand new risks

This also raises questions for regulators. If tools like ChatGPT and other voice-generating AI are being used for fraud, who’s responsible for protecting the public? And what rules need to change?

Final Thoughts

Sam Altman’s message to the Federal Reserve was simple but urgent: AI can now fake your voice, and that means old security systems are no longer safe.

Financial institutions, tech companies, and regulators will all need to move quickly to protect consumers from a new era of digital fraud — one where even your voice can be used against you.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.