Nvidia Reports Strong Q3 Earnings, Fueled by High AI Demand

Nvidia has posted strong third-quarter earnings that exceeded both sales and earnings expectations, continuing to benefit from the growing demand for its AI chips. However, the company’s shares fell by 2% in after-hours trading despite these positive results.

Key Financial Highlights

- Revenue: $35.08 billion, surpassing the $33.16 billion expected by analysts.

- Earnings per Share (EPS): 81 cents adjusted, better than the 75 cents per share expected.

Looking ahead, Nvidia forecasts approximately $37.5 billion in revenue for the current quarter, plus or minus 2%, exceeding the $37.08 billion analysts had predicted. This implies a year-over-year growth of about 70%, a significant slowdown from the 265% growth reported for the same period last year.

Growth Overview

Nvidia’s revenue surged 94% year-over-year for the quarter ending October 27, continuing the company’s growth trajectory. However, this marked a decline from previous quarters, where Nvidia posted 122%, 262%, and 265% growth, respectively.

Despite a slowdown in growth, Nvidia remains the primary beneficiary of the ongoing artificial intelligence boom. In 2024, Nvidia’s shares have nearly tripled, making it the most valuable publicly traded company.

Data Center Division Driving Growth

Nvidia’s data center business, which handles sales of AI processors and related components, now constitutes the majority of the company’s revenue. The division generated $30.8 billion, reflecting a 112% increase from the previous year. This exceeded the $28.82 billion analysts had expected. However, not all of this revenue came from chips—about $3.1 billion came from sales of networking parts.

Net Income and Margins

Net income for the quarter grew to $19.3 billion, or 78 cents per share, compared to $9.24 billion, or 67 cents per share, in the same period last year. Nvidia’s gross margin also increased to 73.5%, slightly above analyst expectations, driven by higher sales of data center chips.

AI Chips: Blackwell and H200

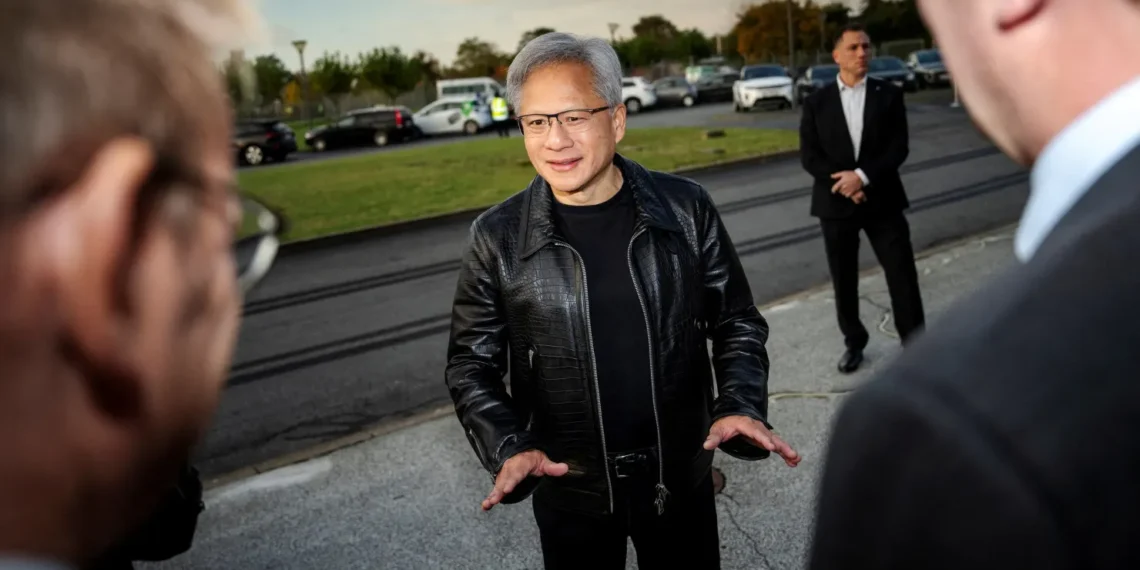

Nvidia’s next-generation AI chip, Blackwell, is now in full production, with 13,000 samples already shipped to major clients such as Microsoft, Oracle, and OpenAI. Nvidia’s CEO, Jensen Huang, highlighted that Blackwell is in “full production,” and it is now in the hands of most of the company’s major partners who are working to integrate the chips into their data centers.

Nvidia’s CFO, Colette Kress, confirmed that shipments of Blackwell chips will increase next year, with the company expecting “several billion dollars” in Blackwell-related revenue in the fourth quarter. Additionally, sales of Nvidia’s current-generation AI chip, the H200, saw significant growth during the quarter.

Both the Hopper and Blackwell systems face supply constraints, with demand for Blackwell expected to outstrip supply for several quarters into fiscal 2026.

Gaming Business Performance

Nvidia’s gaming division generated $3.28 billion in revenue, exceeding StreetAccount’s expectation of $3.03 billion. The increase in gaming sales is attributed to higher demand for GPUs for PCs and laptops, as well as increased revenue from gaming console chips. Nvidia’s chip powers the Nintendo Switch, contributing to the rise in console chip sales.

Smaller Segments: Automotive and Professional Visualization

While Nvidia’s gaming and data center divisions are the company’s largest revenue drivers, its automotive and professional visualization segments also showed growth.

- Automotive: Sales in this segment reached $449 million, a 72% increase year-over-year, largely driven by demand for self-driving car chips and chips used in robotics.

- Professional Visualization: This segment accounted for $486 million in revenue, marking a 17% increase from the previous year.

Conclusion

Nvidia continues to lead the AI chip market with robust growth, driven primarily by its data center business and strong demand for its next-generation chips like Blackwell. While the company is experiencing a slight slowdown in growth rates, it remains poised for continued success, with significant revenue expected from AI chip sales and sustained demand across its gaming and automotive sectors.

Source

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.