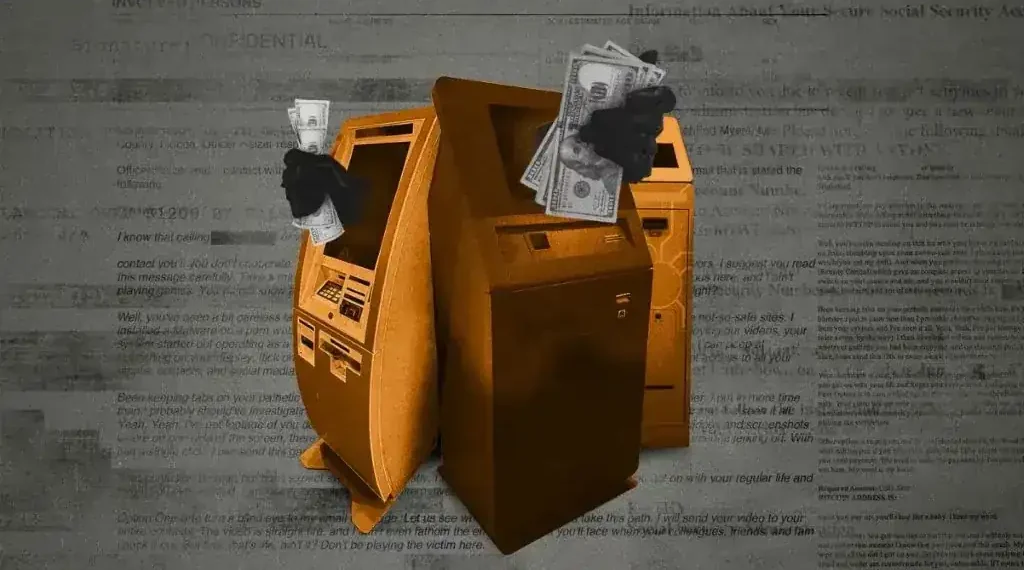

A CNN investigation has documented dozens of fraud cases connected to individual cryptocurrency ATMs in the United States. Authorities warn these machines, which allow users to convert cash into digital currency, have been increasingly exploited by scammers targeting unsuspecting Americans. Regulators and lawmakers are exploring new rules to limit potential abuses in the growing crypto ATM sector.

How Crypto ATMs Are Exploited by Scammers

Cryptocurrency ATMs, often found in convenience stores and retail locations, have become a tool for organized fraud. Victims are typically instructed by phone or text to deposit large sums of cash into these machines under false pretenses, such as paying fictitious fines, taxes, or debts. CNN’s investigation revealed at least a dozen fraud cases tied to a single ATM, indicating a broader pattern rather than isolated incidents.

Scammers often impersonate law enforcement or government officials, exploiting limited public knowledge about crypto technology. Elderly individuals are particularly targeted, and reports show victims from all socioeconomic backgrounds, including professionals and executives, have fallen prey to these schemes.

Rapid Transfers and Law Enforcement Challenges

Once cash is deposited into a crypto ATM, funds can be quickly converted into digital currency and sent overseas, frequently bypassing U.S. law enforcement jurisdictions. The FBI reported that Americans lost approximately $240 million to crypto ATM-related fraud in the first half of 2025 alone. Recovery of these funds is often difficult, particularly when funds are routed through exchanges in countries with limited regulatory cooperation.

Investigation Findings and Data Analysis

CNN reporters reviewed more than 700 fraud reports obtained from police departments, state offices, and the Federal Trade Commission over several months. By tracking addresses and transaction locations, investigators identified recurring ATMs repeatedly used in scams. While the analysis highlighted the widespread nature of these frauds, investigators emphasized that victims should assume any unsolicited request to deposit cash into a crypto ATM is almost certainly a scam.

Industry Response and Legal Disputes

Operators of crypto ATMs, such as CoinFlip, dispute allegations that their machines profit from scams. Companies cite reports, including one by TRM Labs, suggesting only 1.2% of cash-to-crypto transactions were illicit in 2023. However, state-level investigations, such as those in Washington, D.C., have claimed that in some cases, more than 90% of ATM deposits were linked to fraud.

Industry representatives argue that most transactions are legitimate and point to compliance programs designed to protect consumers. These include monitoring unusual activity, verifying transactions, and providing educational materials for users unfamiliar with cryptocurrency.

Global and Organized Fraud Networks

Some U.S. cases have identified individuals connected to sophisticated, transnational fraud rings, including operations in India and Myanmar. In certain instances, employees at foreign scam compounds are reportedly forced to participate in financial fraud targeting Americans. These global networks complicate efforts to trace and recover stolen funds, highlighting the international scope of crypto-related crime.

Regulatory Efforts and Future Oversight

Several U.S. states have enacted laws aimed at curbing crypto ATM fraud, including daily transaction limits. Yet, lobbying by crypto ATM companies has influenced some legislation, resulting in more permissive rules in certain jurisdictions. Federal regulators are exploring additional safeguards, but comprehensive national oversight remains limited. Analysts predict regulatory debates may continue for several years, balancing consumer protection with the rapid expansion of cryptocurrency infrastructure.

Consumer Guidance and Prevention Tips

Authorities urge the public to remain cautious when contacted unexpectedly with demands for payment via crypto ATMs. Experts recommend verifying claims directly with official agencies and avoiding any unsolicited transfer of funds to digital currencies. Public awareness campaigns are increasingly important to counter these sophisticated schemes and reduce financial losses.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.