PSA: You’re Paying 24% More for Vinyl — And It’s Not Just Inflation

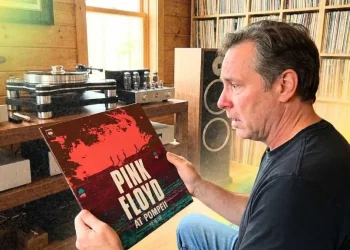

The vinyl boom is alive and spinning — but so are the prices. Here’s why your favorite records are costing more than ever, and why labels aren’t in a hurry to change that.

Over the last five years, the average price of a brand-new vinyl record has jumped from $29.82 to $37.22 — a 24% spike, according to Discogs. While inflation and rising production costs are part of the story, there’s a deeper reason collectors are feeling the pinch: record labels know you’ll pay.

Yes, vinyl is expensive to make. Especially for smaller runs, where producing a deluxe pressing with colored vinyl can still cost up to $15 per unit. Labor shortages and higher wages at pressing plants have added to the burden, too.

“As the cost of raw materials and living has gone up, so have manufacturing expenses,” explains Travis Searle of Guestroom Records in Louisville, KY.

But here’s the twist: larger volume pressings can bring production down to $4–$7 per unit. Still, that savings often isn’t passed on to consumers.

If we adjust for inflation, that $29.82 average in 2020 should be about $36.48 in 2025. So sure, prices are rising — but not wildly beyond expectations.

The extra few bucks? That’s where marketing gimmicks and collector psychology come in.

“Labels have realized there’s real money in vinyl now,” says Searle. “It used to be a niche product. Now it’s a goldmine.”

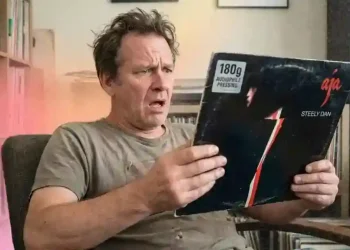

Record companies are now leaning hard into the limited-edition hype cycle. A prime example: In March 2025, the band Ghost dropped a “mystery” vinyl with only 6,000 copies worldwide. Price tag? $45.

Within weeks, it was reselling for over $460 on eBay.

“Fans will pay for records that feel intentional,” says Discogs VP Jeffrey Smith. “But when labels flood the market with endless variants and pointless reissues, collectors start to feel like walking ATMs.”

Sticker shock is starting to shape buyer behavior. A survey by Channel 33 RPM found 70% of collectors are cutting back, with many saying they’re now more selective with purchases.

“I already own most of what I love,” one Discogs user shared. “Now I only buy what I really want.”

Gen Z collectors are especially price-sensitive. According to a 2025 Vinyl Alliance report, one-third of younger fans are scaling back their buying habits — even as nearly half still believe vinyl is “expensive but worth it.”

To cope with rising prices, many collectors are turning to the used market. On Discogs, 78% of sales are for used records, where fans can often save up to 47% compared to new pressings.

Even buying “like new” used records typically shaves off about 23% on average.

Despite everything, vinyl sales are still booming. Discogs reported a 51% increase in sales from 2020 to 2023, and 2024 saw over 105.7 million items cataloged — a record high.

But industry experts caution that pushing too hard on gimmicks and inflated pricing could backfire.

“Perception is shifting,” says Philip Barton of Sister Ray Records in London. “Prices feel out of control — and fans are noticing.”

Albums that once cost $6–$10 now go for $15–$30. That’s not just inflation — that’s demand and deliberate pricing strategy.

As Jeffrey Smith puts it, “Keep treating fans like a revenue stream instead of a community, and they’ll remember. The future of vinyl belongs to those who get this right.”

So next time you’re holding a $45 mystery variant in your hands, ask yourself: Are you buying the music — or just the bait?

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.