Nvidia’s Sales Surge 78% on AI Demand, Company Gives Strong Forecast

AI Boom Powers Nvidia’s Record Growth

Nvidia continues to dominate the AI revolution, reporting a 78% surge in quarterly revenue, fueled by strong demand for its AI-focused chips. The company’s fourth-quarter earnings, announced Wednesday, exceeded Wall Street expectations, reinforcing its confidence in continued growth through 2025.

Despite its impressive performance, Nvidia’s stock remained flat in extended trading. However, the company’s guidance for Q1 2025 signals sustained momentum, projecting $43 billion in revenue—higher than analysts’ expectations.

Key Financial Highlights (Compared to Analyst Estimates)

Revenue: $39.33 billion (vs. $38.05 billion expected)

Earnings Per Share (EPS): $0.89 adjusted (vs. $0.84 expected)

Net Income: $22.09 billion (up from $12.29 billion a year ago)

Gross Margin: 73% (down slightly due to higher costs in new data center products)

Nvidia’s full-year revenue surged 114% to $130.5 billion, marking a historic rise driven by its dominance in AI accelerator chips.

AI Chip Business: The Backbone of Nvidia’s Growth

Data Center Revenue: $35.6 billion in Q4, a 93% annual increase, exceeding estimates of $33.65 billion.

AI Chip Sales (Blackwell & Hopper): Account for 91% of total sales, up from 83% a year ago.

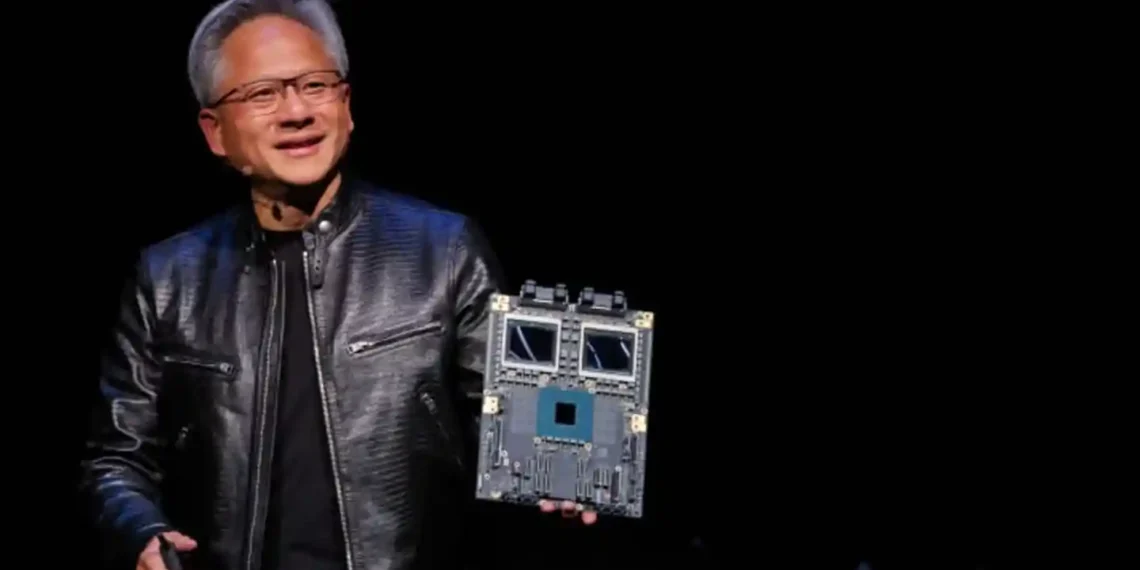

Blackwell AI Chips: $11 billion in Q4 sales, with CEO Jensen Huang calling demand “amazing.”

Why It Matters:

- Nvidia’s Blackwell AI processors are experiencing the fastest product ramp in company history, with cloud giants like Amazon, Microsoft, and Google driving sales.

- AI inference (running AI applications) is expected to require exponentially more computing power, boosting future demand for Nvidia’s chips.

Challenges & Areas of Concern

Networking Sales: $3 billion in Q4, down 9% year-over-year, despite being a key growth focus.

Gaming Revenue: $2.5 billion, below the $3.04 billion estimate, marking an 11% annual decline.

Automotive & Robotics Chips: While still a small segment, revenue hit $570 million, a 103% increase year-over-year.

Nvidia also addressed concerns about custom AI chips being developed by tech giants like Amazon, Microsoft, and Google. CEO Huang reassured investors, saying, “Just because a chip is designed doesn’t mean it gets deployed.”

Looking Ahead: Can Nvidia Maintain Its Growth?

- Q1 2025 Forecast: $43 billion revenue, implying a 65% year-over-year growth—a slowdown from the 262% growth in Q1 2024.

- AI Demand Continues: Nvidia expects new AI models to require up to 100 times more processing power, fueling future chip sales.

- Stock Buybacks: Nvidia spent $33.7 billion on share repurchases in fiscal 2025.

Bottom Line: Nvidia remains the dominant force in AI hardware, but growth may slow as the company scales. The focus now shifts to how quickly it can deliver next-generation AI processors and expand into new markets like robotics and automotive AI.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.