CNBC Daily Open: Why Markets Crumbled After Fed’s Rate Cut

Key Takeaways:

- The Federal Reserve reduced interest rates by 25 basis points but projected fewer rate cuts in 2025 than previously anticipated.

- U.S. markets faced a sharp sell-off, with major indices experiencing significant losses.

- Investor disappointment stemmed from dashed expectations of aggressive rate reductions in the near future.

Fed’s Decision: A Modest Cut but a Tighter Future

On Wednesday, the U.S. Federal Reserve lowered its interest rate by 25 basis points, setting its target range to 4.25%-4.5%. While this marked a step toward easing monetary policy, the central bank’s updated projections signaled only two rate cuts for 2025—a notable downgrade from the four cuts anticipated in September.

This revised outlook delivered a blow to markets that had hoped for a more aggressive easing trajectory.

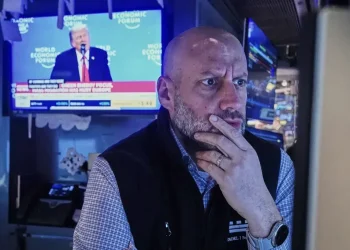

Market Reaction: A Sell-Off Frenzy

U.S. markets tumbled in response to the Fed’s announcement:

- Dow Jones Industrial Average: Dropped over 1,000 points (-2.58%), marking its 10th consecutive day of losses.

- S&P 500: Declined 2.95%.

- Nasdaq Composite: Fell 3.56%.

Across the Atlantic, the Stoxx 600 in Europe closed up 0.15% before the Fed’s decision, escaping the U.S. market’s turbulence.

Individual Stock Movements: Tesla and Micron Hit Hard

- Tesla: Shares plummeted 8.3%, their steepest one-day drop since November 2016, as analysts flagged the stock’s disconnect from fundamentals amid broader market weakness.

- Micron: The chipmaker’s stock plunged more than 15% in extended trading. While it exceeded last quarter’s earnings expectations, Micron issued a disappointing revenue forecast of $7.9 billion for the current quarter, well below analysts’ estimates of $8.98 billion.

Why Investors Were Disappointed

The markets’ reaction wasn’t about the Fed’s actual rate cut—it was about the revised dot plot.

Before the Fed meeting, markets widely expected the 25 basis-point reduction, with futures pricing in a 98% probability of the move. Investors had even hoped for another rate cut as soon as January, with an 81.6% chance forecasted.

However, Fed Chair Jerome Powell quashed those expectations.

“With today’s action, we have lowered our policy rate by a full percentage point from its peak, and our policy stance is now significantly less restrictive,” Powell said.

“We can therefore be more cautious as we consider further adjustments to our policy rate.”

Following Powell’s comments and the updated projections, the chance of another January rate cut plummeted to just 6.4%.

The Emotional Blow: A Shift in Market Sentiment

This shift in expectations felt like a harsh reality check for investors. The optimism that drove recent market performance crumbled as hopes of aggressive rate cuts gave way to the Fed’s cautious tone.

David Russell, global head of market strategy at TradeStation, summed up the sentiment:

“Good-bye punch bowl. No Christmas cheer from the Fed.”

Bottom Line: The Power of Expectations

Wednesday’s sell-off is a reminder of how markets often move not on present actions, but on expectations for the future. The Fed’s decision to moderate its easing plans, coupled with Powell’s cautious messaging, recalibrated investor sentiment—leading to the dramatic market retreat.

For now, markets will closely watch every word and signal from the Fed, as the balance between cautious optimism and economic reality continues to shape financial markets.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.