Consumer Financial Watchdog Ordered to Halt Oversight Under New Acting Director

CFPB Employees Told to Cease Work on Financial Abuse Cases

The Consumer Financial Protection Bureau (CFPB)—the nation’s top consumer financial watchdog—has been ordered to halt nearly all operations, including oversight of big banks, payday lenders, and financial institutions, according to an internal email obtained by CNN.

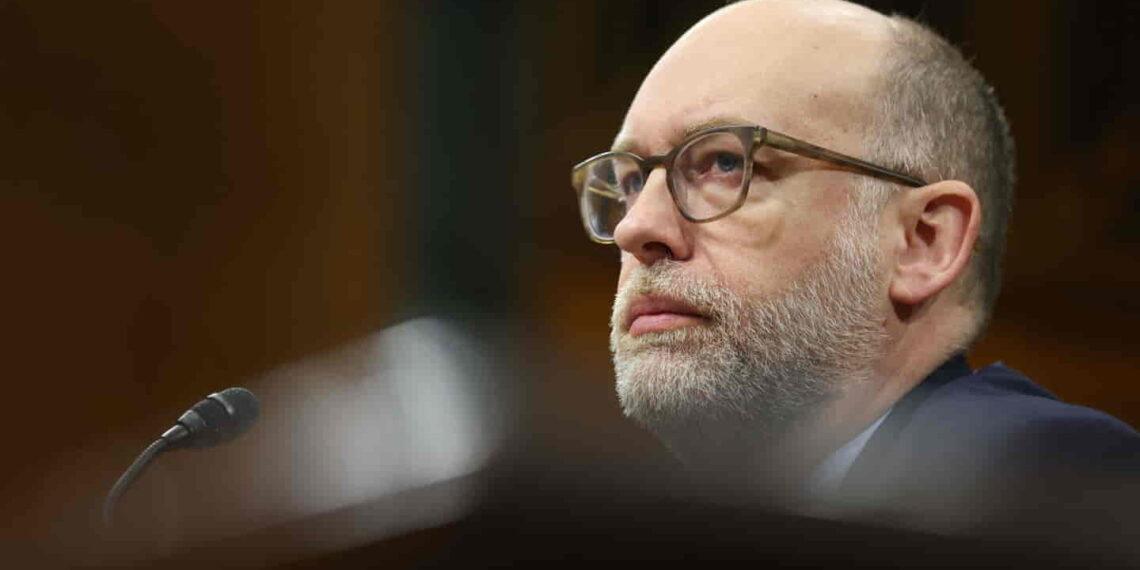

Acting Director Issues Sudden Directive

On Saturday night, Russell Vought, the newly appointed acting director of the CFPB, sent a bureau-wide email stating:

“Effective immediately, unless expressly approved by the Acting Director or required by law, all employees, contractors, and other personnel of the bureau shall…cease all supervision and examination activity.”

This unprecedented move effectively suspends CFPB’s ability to protect consumers from financial abuse, leaving $18 trillion in consumer debt unmonitored, according to a former CFPB official who spoke to CNN anonymously.

A Step Beyond Prior Restrictions

This order goes even further than a previous directive issued by Treasury Secretary Scott Bessent on February 3, which had already halted rulemaking, court filings, and public communications. Vought’s new directive adds supervision and enforcement to the freeze, leaving American consumers without critical financial protections.

Funding Freeze and Bureau Oversight

Vought also announced on X (formerly Twitter) that he had notified the Federal Reserve that the CFPB would not be drawing its next round of funding, claiming the agency’s $711.6 million balance was “excessive” and not “reasonably necessary” for operations.

House Democrats Push Back

In response, dozens of House Democrats sent a letter to Treasury Secretary Scott Bessent, urging him to rescind what they called an ‘illegal stop work order’. However, as of now, the CFPB has not responded to requests for comment.

Government Takeover of CFPB Systems

Following Vought’s appointment, officials from Elon Musk’s Department of Government Efficiency (DOGE) reportedly deleted the CFPB’s official X account and gained administrative access to bureau systems, including:

Website content management system

Back-end operations

Personnel directories

What This Means for Consumers

With the CFPB effectively sidelined, financial institutions now face reduced oversight, potentially leaving millions of Americans vulnerable to predatory practices. As uncertainty looms, lawmakers and consumer advocates are closely watching for the next steps in what could be a major shift in financial regulation policy.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.