China’s Secret Weapon in Trump’s Trade War: Rare Earth Dominance

As trade tensions between the U.S. and China reignite, Beijing has quietly played one of its strongest cards — and it’s not tariffs or tech bans. It’s rare earths.

These obscure minerals, vital to everything from iPhones to fighter jets, have once again put China in the driver’s seat of global supply chains. And in this battle, former President Donald Trump — who launched the initial trade war — may find himself with little leverage.

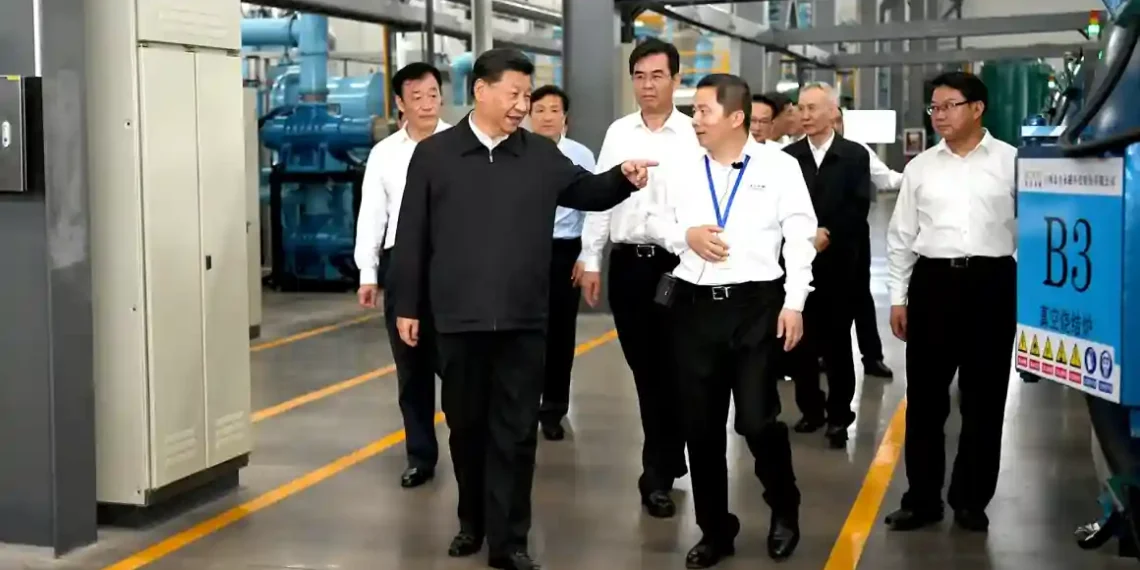

Back in 2019, as Trump’s first trade war escalated, Chinese leader Xi Jinping paid a symbolic visit to a factory in Ganzhou, a city known for processing rare earth minerals. Xi declared these metals a “vital strategic resource,” a quiet but clear message: China holds the keys to the technologies of the future.

Fast forward to today — and that message is louder than ever.

While rare earths can be found in many countries, China dominates the supply chain. According to the International Energy Agency, it controls 61% of global mining and an astonishing 92% of processing. That’s the step that turns raw materials into usable components — and it’s where China has built an unshakable lead.

On April 4, China tightened its grip further by imposing new export controls on seven key rare earth minerals, including their alloys and magnet products. Companies must now get Beijing’s permission before shipping them out — a direct response to Trump’s 34% tariff hike on Chinese goods.

And the impact has been immediate.

Since the order took effect, at least five American and European companies have had rare earth magnet shipments halted in China, according to industry consultant John Ormerod.

“They were caught off guard,” Ormerod told CNN. “There’s a lot of confusion about the new licensing rules.”

It’s not just about paperwork. These magnets are essential for electric vehicles, military aircraft, and even MRI machines. Losing access to them — even briefly — can ripple through entire industries.

Joshua Ballard, CEO of USA Rare Earth, pointed out that the controls focus on “heavy” rare earths — the rarest, most expensive, and most controlled. “This is China’s best move,” he said. “They don’t have much leverage with tariffs, but here, they’ve got a hammer.”

China’s rare earth dominance didn’t happen overnight. It began in the 1950s but accelerated in the 1980s and 1990s, when China blended low labor costs and lax regulations with imported Western technologies.

By the early 2000s, Western manufacturers — unable to compete with China’s pricing and scale — exited the business. The U.S. lost not only its production base but also the expertise.

“Much of the know-how is gone,” said Ormerod. “It’s capital-intensive, and China simply out-invested everyone else.”

Today, the U.S. relies on China for around 70% of its rare earth imports.

This week, Trump ordered a federal investigation into critical mineral imports, citing national security risks tied to foreign dependency. But building a domestic supply chain won’t be easy — or fast.

Since 2020, the Pentagon has spent over $439 million trying to rebuild rare earth infrastructure. Its goal: a mine-to-magnet supply chain that can meet all U.S. defense needs by 2027.

Some U.S. companies see opportunity in China’s export crackdown.

Phoenix Tailings, a Massachusetts startup, claims it can refine rare earths with zero emissions — using only materials from the U.S., Canada, and Australia. CEO Nicholas Myers says they produce 40 metric tons per year now and aim for ten times that soon.

“It’s all domestic,” Myers said. “We don’t rely on China at all.”

USA Rare Earth is also scaling up, building a magnet plant in Texas and working on processing tech for its West Texas mine — a deposit rich in all the minerals China just restricted. But it’s still early days.

“The question is: how do we do this faster?” Ballard asked. “We’ve got the resources. Now we need speed.”

China’s move isn’t just a trade tactic — it’s a wake-up call. After years of warnings, American industries are feeling the pressure to reduce dependence on a single foreign supplier.

While the U.S. scrambles to catch up, China is sending a message loud and clear: In this tech-driven trade war, the side with the rare earths may have the rare advantage.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.