Stock Market Update: Wall Street Slips as Nvidia Drops and Tariff Concerns Rise

Wall Street faced a mixed trading session on Thursday, with U.S. stock indexes drifting lower following a rough stretch of economic concerns.

Market Performance Overview

- S&P 500: Down 0.4%, giving up early modest gains.

- Dow Jones Industrial Average: Up 103 points (0.2%) as of 10 a.m. Eastern Time.

- Nasdaq Composite: Down 1.1%, weighed down by tech stocks.

The stock market has struggled in recent sessions due to weaker-than-expected economic data, which knocked the S&P 500 off its record high from last week.

Nvidia Swings to a Loss Despite Strong Earnings

Nvidia, one of Wall Street’s most influential stocks, had a volatile session. The AI chip giant initially rose at market open after reporting better-than-expected quarterly earnings, but quickly fell 1.2% into negative territory.

The drop comes amid concerns following Chinese AI company DeepSeek’s announcement that it developed a large language model that can compete with top AI systems without relying on Nvidia’s expensive chips. This raised questions about future AI-related spending, which had been a major driver of Nvidia’s stock surge.

Despite this, UBS analysts led by Timothy Arcuri noted that Nvidia’s earnings and forecasts were strong enough to keep investor sentiment positive. However, they weren’t impressive enough to push the stock higher.

Salesforce Falls on Weak Forecasts

Salesforce (CRM) tumbled 4.3%, despite reporting strong quarterly earnings that exceeded analyst expectations. The decline came after the company issued disappointing revenue forecasts, which fell short of Wall Street estimates.

Trump’s Tariff Announcement Weighs on Markets

Adding to the market’s unease, former President Donald Trump confirmed that new tariffs on Canadian and Mexican imports will go into effect on March 4th. He also announced an additional 10% tariff on Chinese products starting the same day.

The prospect of higher tariffs has raised fears of increased costs for U.S. consumers, especially as inflation remains stubbornly high. While some analysts believe Trump may use the tariffs as negotiation leverage, the mere discussion of trade barriers has already made U.S. consumers more cautious about spending—a key factor keeping the economy afloat.

Bond Market Reaction & Economic Data

Treasury yields fluctuated following Trump’s tariff announcement and the release of two key U.S. economic reports:

- GDP Report: The government maintained its estimate of economic growth for the last quarter of 2024 but raised its inflation estimate, signaling persistent price pressures.

- Unemployment Data: Jobless claims hit a three-month high, though still far below recession levels.

The 10-year Treasury yield edged up to 4.27%, after hitting 4.30% earlier in the morning.

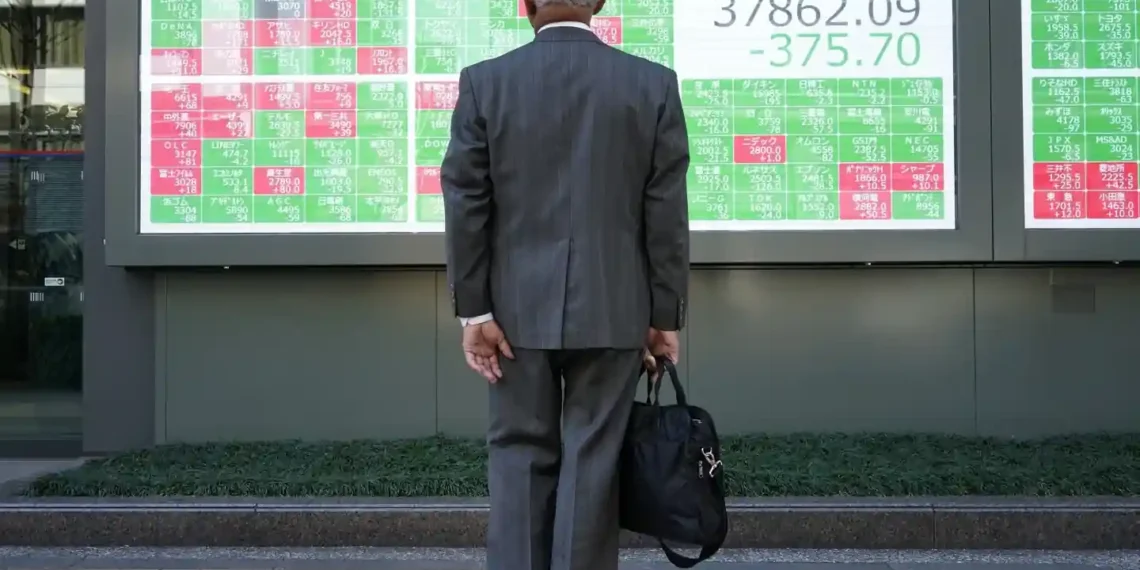

Global Market Performance

- Germany’s DAX: Fell 1.3% amid economic uncertainty.

- Japan’s Nikkei 225: Rose 0.3%, bucking the trend.

Conclusion

The stock market remains volatile, with tech weakness, tariff concerns, and inflation worries keeping investors on edge. While Nvidia and Salesforce’s earnings reports highlighted ongoing growth, their stock movements suggest that investors are demanding more than just strong numbers—they want certainty about future performance.

As the market continues to digest economic data and geopolitical risks, investors should brace for further swings in sentiment and stock prices.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.