WASHINGTON (AP) – U.S. President Donald Trump has signed an executive order authorizing tariffs on goods from any country that sells or provides oil to Cuba, escalating economic pressure on the island as it struggles with a deepening energy shortage. The move reinforces Washington’s long-standing hardline policy toward Havana and signals a broader effort to discourage third countries from maintaining energy ties with the Cuban government.

The order places Mexico in a particularly sensitive position. Mexico has emerged as one of Cuba’s most important oil suppliers in recent years, even as President Claudia Sheinbaum has sought to maintain a cooperative relationship with the Trump administration. Mexican officials have framed their support for Cuba as humanitarian and contractual, while avoiding direct confrontation with Washington.

The announcement comes against the backdrop of mounting uncertainty inside Cuba, where fuel shortages have disrupted daily life and economic activity. Long lines for gasoline have become common, and the prospect of further restrictions on oil supplies has intensified public anxiety across the island.

Tariffs aimed at third-country oil suppliers

Under the executive order signed Thursday, the United States would impose tariffs on imports from countries that sell or provide oil to Cuba. While the administration has not detailed tariff rates or timelines, the policy marks a sharp warning to governments that continue to supply fuel to Havana despite U.S. sanctions.

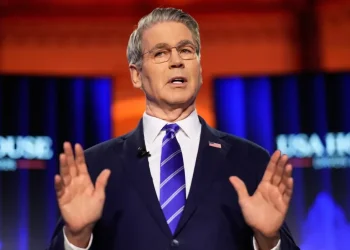

Asked by reporters whether the goal was to “choke off” Cuba, Trump rejected the phrasing but offered a bleak assessment of the island’s prospects.

“The word ‘choke off’ is awfully tough,” Trump said. “I’m not trying to, but it looks like it’s something that’s just not going to be able to survive.”

The White House has not released further technical guidance on how compliance would be measured or how exemptions, if any, would apply. Analysts say the lack of detail adds uncertainty for energy exporters and manufacturers alike, particularly in Latin America.

Mexico caught between Washington and Havana

Mexico is widely seen as the country most directly affected by the order. Its state-owned oil company, Pemex, has played a key role in supplying Cuba with crude and refined products during the island’s energy crisis.

Trump and Sheinbaum spoke by phone on Thursday morning, but Cuban oil shipments were not discussed, according to the Mexican president.

“We didn’t address the issue of Cuba,” Sheinbaum told reporters later that day.

She added that Mexico’s foreign affairs secretary had raised the issue with U.S. Secretary of State Marco Rubio, emphasizing that Mexico considers it “very important” to maintain humanitarian aid to Cuba. Sheinbaum also said Mexico was willing to act as an intermediary between Washington and Havana.

Speculation has grown in recent days that Mexico might scale back oil shipments under U.S. pressure. The new executive order is likely to intensify scrutiny of Mexico’s energy policy toward Cuba and test Sheinbaum’s effort to balance diplomatic ties with both governments.

Oil shipments and shifting volumes

Pemex reported in its most recent filings that it shipped nearly 20,000 barrels of oil per day to Cuba between January and Sept. 30, 2025. That period included a visit by Secretary of State Rubio to Mexico City, after which analysts observed a notable decline in shipments.

Jorge Piñon, an energy expert at the University of Texas Energy Institute who tracks oil flows using satellite data, said shipments later fell to around 7,000 barrels per day. While still significant for Cuba, the reduction suggested growing caution by Mexican authorities amid U.S. pressure.

Sheinbaum has offered limited clarity on the issue. Earlier this week, she said Pemex had at least temporarily paused some shipments, describing the move as part of normal fluctuations in oil supply rather than a response to Washington.

“It was a sovereign decision,” she said, stressing that it was not made under U.S. pressure.

Ambiguity over Mexico’s position

Mexican officials have repeatedly avoided confirming whether oil exports to Cuba have been reduced or suspended. On Wednesday, Sheinbaum said she had never claimed shipments were fully halted and insisted that “humanitarian aid” to Cuba would continue.

She added that oil deliveries are governed by Pemex contracts.

“So the contract determines when shipments are sent and when they are not sent,” she said.

The lack of specificity has underscored the diplomatic strain facing Mexico and other Latin American countries as the Trump administration adopts a more confrontational posture toward governments aligned with Cuba.

For Mexico, the stakes extend beyond Cuba policy. Any U.S. tariffs imposed under the new order could affect Mexican exports unrelated to energy, raising concerns among manufacturers and trade officials.

Cuba’s worsening energy crisis

Cuba has faced persistent energy and economic difficulties in recent years, exacerbated by aging infrastructure, fuel shortages, and U.S. sanctions. The government has relied heavily on oil shipments from foreign partners, including Mexico, Russia, and Venezuela, to keep power plants and transportation systems running.

Trump has repeatedly argued that restricting energy supplies will hasten political change in Cuba. He has also said that Venezuelan oil will no longer reach the island following a U.S. military operation that, according to his administration, removed former Venezuelan president Nicolás Maduro. Independent confirmation of the broader regional impact of that operation remains limited.

On the ground in Cuba, the consequences of fuel uncertainty are already visible. Drivers in several cities reported waiting hours in line for gasoline this week, unsure when supplies would be replenished or whether further disruptions were imminent.

Uncertain impact of the new order

It remains unclear how quickly the executive order will be implemented or how rigorously it will be enforced. The administration has not specified whether humanitarian exceptions will apply or how it will distinguish between commercial oil sales and aid-based shipments.

For Cuba, any additional reduction in fuel imports would deepen an already severe crisis. For Mexico and other potential suppliers, the order introduces new economic and diplomatic risks, forcing governments to weigh longstanding regional ties against the threat of U.S. trade penalties.

As details emerge, the policy is likely to draw close attention across Latin America and beyond, testing the reach of U.S. sanctions and the willingness of partner countries to absorb the costs of defying them.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.