The U.S. Treasury is preparing to launch a new child savings initiative known as “Trump Accounts,” a program tied to President Donald Trump’s tax legislation that would provide a $1,000 investment for eligible newborns whose parents open an account on their behalf.

The initiative is being promoted by the White House as part of a broader economic message focused on affordability, ownership, and long-term financial participation. While the accounts are framed as a way to help narrow wealth gaps over time, the proposal has also drawn criticism from economists and advocacy groups who question whether it meaningfully addresses childhood poverty in the near term.

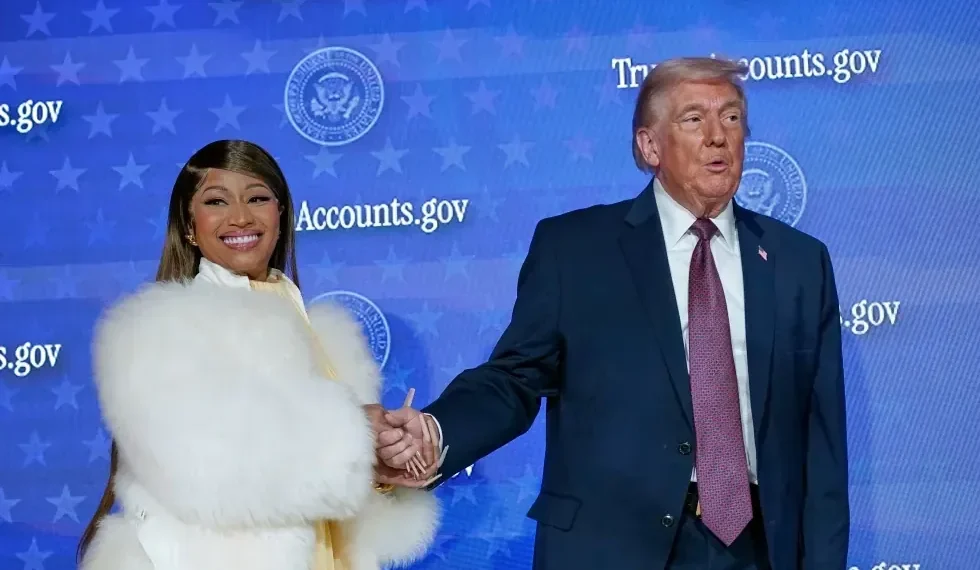

The program was formally highlighted this week at a Treasury-hosted event in Washington attended by Republican lawmakers, business leaders, and public figures, underscoring the administration’s effort to position the accounts as both an economic and ideological policy tool.

What are Trump Accounts?

Trump Accounts are government-seeded investment accounts designed for children, with funds invested in the U.S. stock market through private financial firms. Once opened, the account is locked until the child turns 18, at which point withdrawals are permitted only for specific uses such as higher education expenses, starting a business, or making a down payment on a home.

Under the program, the U.S. Treasury will deposit $1,000 for each qualifying newborn after a parent or guardian opens an account. The funds must be invested in U.S. equity index funds that track the broader stock market, with annual management fees capped at 0.10%, according to Treasury guidelines.

Parents may also make additional contributions using pretax income, similar to retirement savings vehicles. Annual family contributions are capped at $5,000, with parents themselves allowed to contribute up to $2,500 per year. Employers, relatives, philanthropic groups, and local governments may also add funds, though charitable and government contributions do not count toward the annual cap.

Administration officials say the structure is intended to promote early participation in capital markets while limiting costs that could erode long-term returns.

Who qualifies for the $1,000 government contribution?

The $1,000 seed contribution is limited to children born during the Trump administration’s current term. To qualify, a child must be a U.S. citizen, have a Social Security number, and be born between January 1, 2025, and December 31, 2028.

Any parent or legal guardian may open an account for an eligible child, regardless of the parent’s immigration status. However, registration is required; children do not automatically receive the funds unless an account is opened on their behalf.

The funds are not accessible during childhood, except in rare and narrowly defined circumstances. Withdrawals made at age 18 or later will be subject to taxation, depending on how the money is used and prevailing tax rules at the time.

Parents of older children are permitted to open Trump Accounts as well, but those children will not receive the $1,000 government contribution.

Additional bonuses from private donors

Beyond the federal contribution, several wealthy individuals and organizations have pledged to provide supplemental seed funding for children who do not qualify for the Treasury’s $1,000 deposit.

In December, Michael and Susan Dell announced a $6.25 billion commitment to provide $250 contributions for children aged 10 and under who live in ZIP codes with median household incomes of $150,000 or less and who are not eligible for the federal seed money.

Shortly afterward, investor Ray Dalio and his wife, Barbara, pledged $75 million to fund similar $250 contributions for children under 10 in Connecticut, targeting families in qualifying income areas. At this week’s Treasury event, the administration also announced a pledge from investor Brad Gerstner to fund $250 contributions for children under five in Indiana.

Several major corporations, including Uber, Intel, IBM, Nvidia, and Steak ’n Shake, have indicated plans to incorporate Trump Account contributions into employee benefit packages. Treasury Secretary Scott Bessent has encouraged such efforts through what the department calls the “50 State Challenge,” aimed at expanding private-sector participation nationwide.

How and when parents can open an account

Although the accounts will not begin accepting investment contributions until July 2026, parents of eligible children can begin the registration process earlier.

According to Treasury guidance, parents may register by filing Internal Revenue Service Form 4547 when submitting their annual tax return, or through an online portal expected to launch later this year. Registration is a prerequisite for receiving any government or donor-provided seed money.

Families who register by May will receive follow-up instructions detailing how to complete the account setup once the program becomes fully operational.

The policy rationale behind the program

Supporters of Trump Accounts argue that early exposure to long-term investing can help broaden participation in the U.S. financial system, particularly for children born into low-income households. They say the accounts are intended to foster a sense of ownership and financial literacy rather than provide short-term assistance.

The administration has also framed the policy as a response to growing skepticism toward market-based economic systems, emphasizing private investment and individual asset ownership as alternatives to expanded government aid.

Data from the U.S. Securities and Exchange Commission show that about 58% of U.S. households held stocks or bonds in 2022, though ownership remains heavily concentrated, with the wealthiest 1% holding nearly half of total stock market value.

How Trump Accounts compare with state “baby bond” programs

Several U.S. states and local governments have piloted so-called “baby bond” programs in recent years, including California, Connecticut, and the District of Columbia. While similar in concept, those initiatives differ significantly from Trump Accounts in design and targeting.

State baby bond programs are typically restricted to children growing up in poverty, foster care, or households affected by extraordinary hardship, such as the loss of a parent during the COVID-19 pandemic. They are usually managed by public entities rather than private financial firms and exclude children from higher-income families.

Trump Accounts, by contrast, are universally available to qualifying newborns regardless of household income, provided parents take the steps required to open an account.

Criticism and concerns

Critics argue that the accounts do little to address the immediate needs of children in poverty, particularly during early childhood, when families are most likely to struggle with housing, nutrition, and healthcare costs.

Some policy analysts also point to the broader legislative context in which the accounts were created, noting that they were included in the same tax bill that reduced funding for programs such as food assistance and Medicaid. From this perspective, opponents say the accounts may offset future wealth inequality only marginally while coinciding with cuts to existing safety nets.

There are also concerns that the structure could widen wealth gaps over time. Families with sufficient income to make maximum annual contributions would see significantly higher balances than families unable to add funds beyond the initial seed money. Assuming an average annual return of 7%, the government’s $1,000 contribution alone would grow to roughly $3,570 over 18 years.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.