The U.S. stock market is smashing records, global equities are rallying, and even bonds — typically the safer, steadier part of a portfolio — are performing well. Gold and cryptocurrencies are also climbing. For anyone checking their 401(k) right now, it’s been a feel-good moment across nearly every asset class.

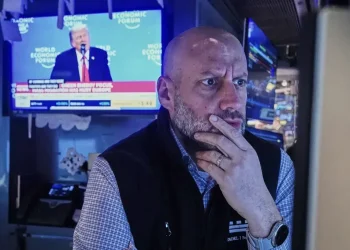

But with markets on fire, financial experts say it’s exactly the right time for investors to pause, reassess, and remember how they felt just months ago — during April’s market tumble sparked by former President Donald Trump’s “Liberation Day” tariff announcements.

Back then, fear and volatility led some investors to sell at a loss, missing the sharp rebound that followed. Others stayed the course and were rewarded. Both experiences now serve as lessons as Wall Street enters another high-risk, high-reward phase.

A historic rally — and a warning

The S&P 500 has surged more than 35% from its April low, with momentum driven by strong corporate earnings and optimism over easing U.S.–China trade tensions. “We’re seeing steady growth without irrational exuberance,” said Mark Hackett, chief market strategist at Nationwide, describing the current environment as a “Goldilocks” economy — not too hot, not too cold.

Yet, history shows markets never rise forever. On average, the S&P 500 experiences a 10% correction every couple of years, and deeper “bear markets” — defined as a drop of 20% or more — hit less often but last longer.

“Fundamentally superior stocks recover quickly and bounce like fresh tennis balls, while inferior stocks bounce like rocks,” noted Louis Navellier, founder and CIO of Navellier & Associates. He remains confident that high-quality companies will continue to drive gains, but warns that “the market will fall eventually — it always does.”

What could derail the rally

Several factors underpin the current bull run, but any disruption could trigger a pullback. Chief among them is the expectation of continued strong corporate profit growth. If companies fail to meet lofty earnings forecasts, valuations could come under pressure — especially in the artificial intelligence (AI) sector, which has fueled much of the market’s optimism.

Chipmaker Nvidia, widely seen as the poster child for the AI boom, trades at 54 times its earnings per share, far above the broader S&P 500’s price-to-earnings ratio of 30. Analysts warn that any earnings disappointment could cause a sharp correction, echoing memories of the early 2000s dot-com bust.

The Fed, inflation, and what’s next

Investors are now focused on the Federal Reserve’s meeting on Wednesday, which could shape market sentiment heading into the new year. The consensus expectation is for the Fed to cut interest rates to support a cooling job market, with more cuts likely through next year.

However, officials have also cautioned that stubborn inflation could delay further easing. Lower rates tend to boost stock prices by making borrowing cheaper, but they also risk stoking inflation — a delicate balance the Fed must manage carefully.

This week also brings key earnings reports from major players like Microsoft and Apple, while Trump’s upcoming meeting with Chinese President Xi Jinping could influence trade sentiment.

Should you sell now? Not so fast

Investors worried about a market bubble may be tempted to sell, but timing the market rarely works. “Being too early is the same as being wrong,” Wall Street veterans say.

Those who sold when then-Fed Chair Alan Greenspan warned of “irrational exuberance” in 1996 missed years of additional gains before the eventual crash. Experts advise focusing on long-term portfolio alignment instead of short-term reactions.

“Make sure your investments are set up so you can stomach the market whether it goes up or down,” said John Kiernan, managing editor of WalletHub.

How much stock exposure is right for you

The ideal mix of stocks, bonds, and other assets depends largely on your age, goals, and risk tolerance.

-

Younger investors can afford more exposure to stocks, since they have decades to recover from downturns.

-

Those nearing retirement may prefer a more balanced approach with a greater share of bonds and dividend-paying stocks for stability.

According to Morningstar, target-date retirement funds — which automatically adjust asset allocations over time — held about 92% in stocks for early-career investors last year, compared to just under 50% for those entering retirement.

“Stocks are essential for growth, but older investors need to prioritize protection,” Kiernan said. “Younger savers have time on their side, while retirees need to safeguard what they’ve earned.”

Volatility check: The calm before the storm?

For now, market volatility remains subdued. The VIX index, often called Wall Street’s “fear gauge,” hovers around 16, signaling calm conditions.

“When the VIX consistently holds above 20, that’s when investors should consider gradually reducing exposure,” said Ben Fulton, CEO of WEBs Investments. “That’s what we saw during the tech bubble, the 2020 pandemic, and the inflation spike of 2022.”

Fulton cautioned that markets can stay irrational longer than expected: “Stepping aside too early can mean missing valuable portfolio appreciation. Maintaining positions during steady climbs is critical.”

The bottom line: Stay smart, not scared

Markets may be roaring, but every bull run eventually faces turbulence. The key, analysts say, is to prepare now — not panic later.

That means reviewing your asset allocation, ensuring you’re not overexposed to high-risk sectors, and confirming your investments align with your time horizon and comfort level.

“The market’s rise is an opportunity, not a guarantee,” said Hackett. “Smart investors use moments like this to rebalance and plan for whatever comes next.”

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.