Tech Stocks Tumble as U.S. Export Curbs Could Cost Nvidia $5.5 Billion

Shares of major chipmakers took a hit Wednesday after Nvidia revealed that new U.S. government export restrictions on artificial intelligence (AI) chips could cost the company a staggering $5.5 billion in lost revenue.

The U.S. government has tightened controls on exports of high-performance chips, particularly those designed for AI applications. Nvidia confirmed that its H20 integrated circuits — along with other chips of similar bandwidth — will now require export licenses for an “indefinite future.”

In a regulatory filing, the company said officials cited concerns that the chips could be used or diverted to supercomputing projects in China.

The market reacted swiftly:

- Nvidia shares fell 5.8% in pre-market trading

- AMD slipped 6.5%

- In Asia, key tech players also dropped:

- Japan’s Advantest fell 6.7%

- Disco Corp. declined 7.6%

- Taiwan Semiconductor Manufacturing Company (TSMC) lost 2.4%

The heightened scrutiny comes amid renewed worries over China’s growing AI capabilities. In January, the debut of DeepSeek, a Chinese AI chatbot, stirred fears in Washington about Beijing’s potential use of advanced U.S. chips in accelerating its own AI development.

Senator Elizabeth Warren recently urged the Commerce Department to clamp down harder on these exports, criticizing what she saw as a pause in the rollout of stricter chip controls.

“I write with great concern regarding reports that the Commerce Department has paused its plan to restrict the export of powerful advanced AI chips like Nvidia’s H20,” Warren wrote in a public letter.

Though the Biden administration previously implemented export controls on advanced AI chips, the H20 model was notably not included at the time.

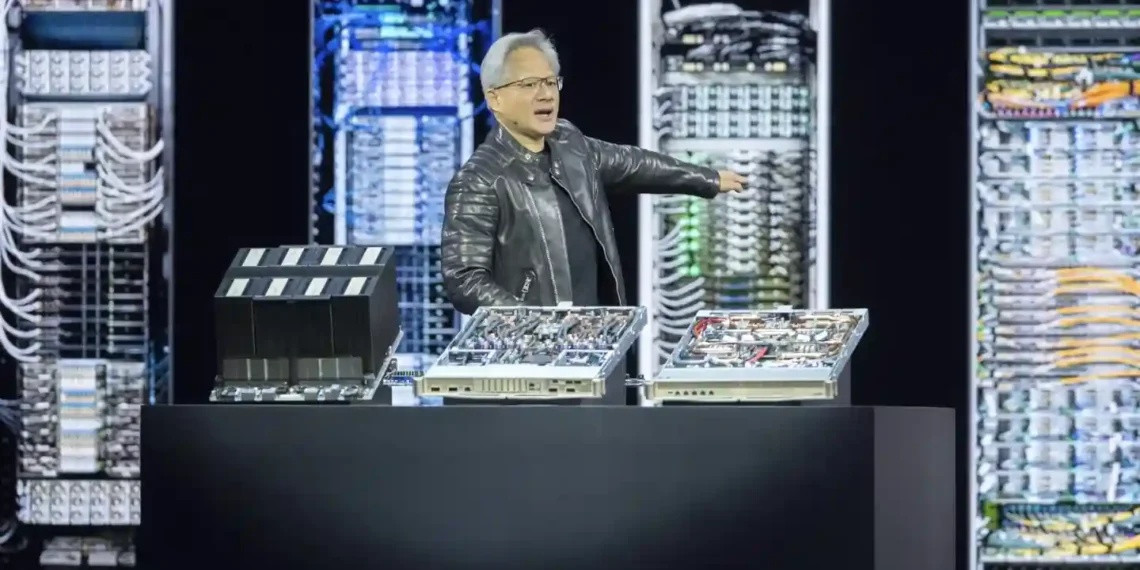

In a bold pivot, Nvidia on Monday announced that it will manufacture its AI supercomputers in the U.S. for the first time, signaling a major investment in domestic tech infrastructure.

The company said it has commissioned over 1 million square feet of manufacturing space in Arizona (for its specialized Blackwell chips) and Texas (for AI supercomputers).

Nvidia estimates that these efforts could fuel the production of up to $500 billion worth of AI infrastructure over the next four years.

Former President Donald Trump quickly seized on Nvidia’s manufacturing announcement, calling it a win for his push to expand U.S.-based semiconductor production. He and other officials had recently discussed plans to shift away from temporary tariff exemptions on electronics and instead develop industry-specific tariffs targeting the semiconductor sector.

The U.S.-China tech rivalry continues to heat up, especially in the race for AI dominance. With Nvidia caught in the middle, the implications are clear: regulatory moves in Washington are sending shockwaves across global tech markets.

As geopolitical tensions rise and export controls tighten, investors and industry leaders alike are watching closely — because in today’s chip wars, every move counts.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.