Southwest Airlines Ends Free Checked Bags Policy

Major Shift in Southwest’s Long-Standing Policy

Southwest Airlines has announced it will begin charging customers for checked bags, ending a decades-long policy that set it apart from competitors. The change takes effect for flights booked on or after May 28 and applies to most passengers, except for those with elite status, business class tickets, or certain airline credit cards.

For years, Southwest built its brand around allowing passengers to check two bags for free, using it as a key selling point against other airlines that charge for luggage. However, executives now say the change is essential for the company’s profitability and long-term strategy.

The airline did not specify exact fees but clarified that only certain customers will continue to receive free checked luggage:

- Rapid Rewards A-List Preferred Members – Two free checked bags

- Business Select Fare Passengers – Two free checked bags

- A-List Members & Other Select Customers – One free checked bag

- Rapid Rewards Credit Card Holders – Credit for one checked bag

- All Other Passengers – Will be charged for checked baggage

In addition to the baggage fee introduction, Southwest also plans to introduce a new basic fare tier for budget-conscious travelers.

Southwest’s CEO Bob Jordan defended the policy shift, citing the need to attract new customer segments and return to expected profit levels.

“We have tremendous opportunity to meet current and future customer needs, attract new customer segments we don’t compete for today, and return to the levels of profitability that both we and our shareholders expect,” Jordan said in a statement.

The airline has faced increasing pressure from investors to improve revenue and cut costs, with some hedge funds gaining influence on its board.

Southwest’s decision comes amid significant financial and operational challenges:

- Job Cuts – Announced plans to eliminate 1,750 jobs (15% of corporate workforce) by June, marking the first major layoffs in its 53-year history.

- Stock Performance – Despite a 9% stock jump on Tuesday, Southwest has been underperforming compared to its competitors.

- Profitability Concerns – Analysts estimate that baggage fees could generate $1.5 billion annually, but may also result in $1.8 billion in lost business from passengers who preferred Southwest for its free bags.

- Upcoming Boarding Changes – Southwest is also set to eliminate its open seating policy and introduce assigned seating in 2025, another departure from its long-standing traditions.

Industry experts believe this change could push some travelers toward competing airlines.

Delta Airlines President Glen Hauenstein commented, “Clearly, some customers chose them because of that, and now those customers are up for grabs.”

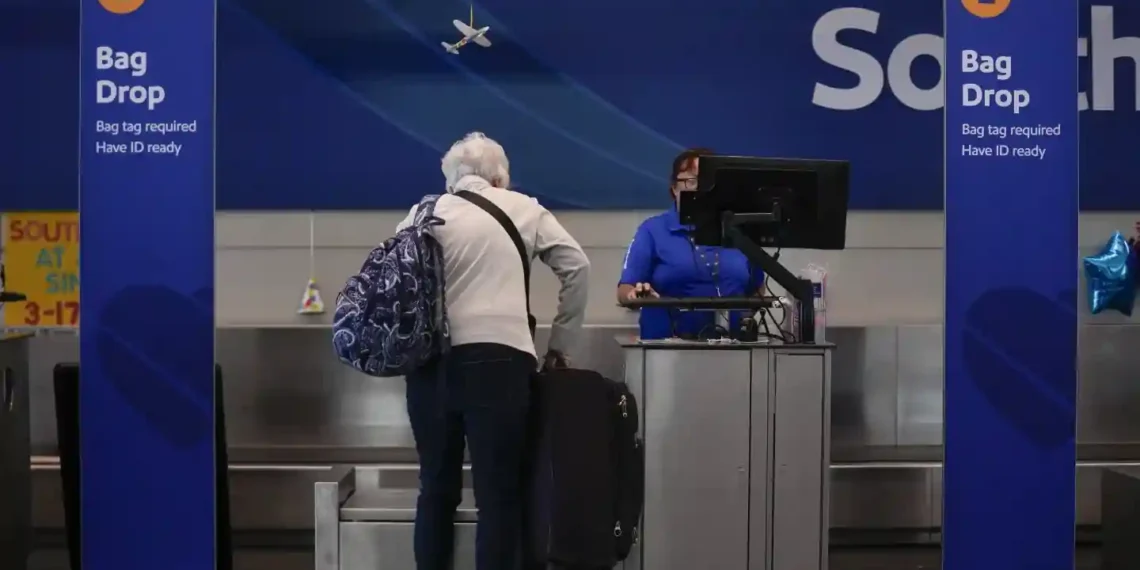

Meanwhile, many Southwest loyalists expressed disappointment. Dorothy Severson, a passenger at Chicago Midway International Airport, said, “I would rather have the free checked bags. That’s one of the main reasons I still fly Southwest.”

Southwest’s move comes amid broader economic uncertainty impacting the airline industry:

- Declining Consumer Confidence – Delta and other airlines have slashed earnings forecasts due to reduced corporate and leisure travel demand.

- Stock Market Impact – Airline stocks have taken a hit in 2024, with JetBlue down 27%, American Airlines down 32%, and United down 22%.

- Southwest’s Revised Forecast – The company now expects revenue per available seat mile to rise between 2% and 4%, a significant drop from its original projection of 5% to 7%.

Beyond baggage fees, Southwest is implementing additional changes, including:

- Red-eye flights – Expanding options for overnight travel.

- Extra legroom charges – Introducing paid seating upgrades.

- Assigned seating – Replacing the airline’s long-standing open-boarding system.

While Southwest hopes these moves will boost revenue, the big question remains: Will customers remain loyal, or will they seek alternatives?

Only time will tell how this bold shift will impact the airline’s future.

This article was rewritten by JournosNews.com based on verified reporting from trusted sources. The content has been independently reviewed, fact-checked, and edited for accuracy, neutrality, tone, and global readability in accordance with Google News and AdSense standards.

All opinions, quotes, or statements from contributors, experts, or sourced organizations do not necessarily reflect the views of JournosNews.com. JournosNews.com maintains full editorial independence from any external funders, sponsors, or organizations.

Stay informed with JournosNews.com — your trusted source for verified global reporting and in-depth analysis. Follow us on Google News, BlueSky, and X for real-time updates.